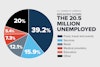

In April alone, 20.5 million Americans lost their jobs because of the coronavirus pandemic and corresponding economic fallout. While no industry has been spared, the downturn has hit some sectors particularly hard.

New analysis produced by the U.S. Chamber of Commerce explores five of the most heavily affected industries, where many businesses have been forced to reduce staffing or close their doors altogether, resulting in steep job losses. In total, these five industries represent 80 percent of America’s job losses in April.

In some of these sectors, many of the jobs are expected to return relatively quickly as restrictions lift across the country. In others, unfortunately, the road to recovery will be longer, and in some cases, many jobs may not return. The U.S. Chamber is advocating for federal relief targeting those hardest hit and likely slow-to-return sectors.

Related: The 10 States Hit Hardest by the Unemployment Crisis

Here’s a look at some of the five most deeply impacted sectors and what the road to recovery and re-employment may look like in each of them.

This analysis reflects the latest data released May 15 by the U.S. Department of Labor. Note that not all subsectors of each industry are listed in the tables below.

1. Food, Travel and Events

Jobs lost to date: More than 8 million

Percent of industry workforce lost: More than 46%

The Great Pause has wiped away almost half of the jobs in the food, travel, and events industries. Amusement, gambling, and recreation has seen 60 percent of its workers lost. This comes as no surprise since stay-at-home orders have forced many of these businesses to close. Most of the businesses that employed many of these workers are small businesses. They will be reopening under occupancy limits, which means a slow recovery. Many of them will not survive, which will mean permanent layoffs for affected employees.

Many of the workers in these industries are receiving unemployment insurance greater than what they earned before COVID-19 hit. Workers receiving benefits get an extra $600 on top of their original benefits. That $600 alone is more than workers in food service, amusement, gambling, recreation, and accommodation earned on the job. That creates a challenge to bring them back into the workforce.

Congress will likely need to consider extending assistance to these businesses after the crisis subsides, but also during the period they are forced to operate at reduced capacity, using a formula based on lost revenue relative to pre-crisis levels. Congress will also have to modify current unemployment benefits and provide greater access to job training to help those who have lost jobs get back to work.

2. Retail

Jobs lost to date: 2.5 million

Percent of industry workforce lost: 14%

Prior to COVID-19, retail was an industry undergoing a long-term transformation. Consumers were shifting to shopping online and traditional brick-and-mortar retailers were adjusting to keep up. Still, up until March, in-store retailers still accounted for 85 percent of all sales, with online sellers making up the remaining 15 percent. Online has been eating into in-store sales over many years. But in April, consumers, forced to stay at home, accelerated their shift to online buying in a big way – reducing in-store sales to 81 percent of all sales and bumping online sales to 19 percent. Such a large shift in a short period of time was unprecedented.

In contrast to food, travel and events, there are many large employers in retail. Some of them were going to struggle to survive, regardless of the current crisis. Some of the jobs lost at these businesses will not come back, unfortunately.

Congress will also have to modify current unemployment benefits and provide greater access to job training to help those who have lost jobs get back to work.

3. Services

Jobs lost to date: 3.3 million

Percent of workforce lost: 17%

The shutdown has eviscerated a huge share of jobs in the service industry. Much like in the food, travel and events industries, this comes as no surprise since many state and local governments have forced these businesses to close. The service industry is also comprised of many small businesses that will be reopening under occupancy limits. This will slow their recovery. Many of them may not survive, which will lead to permanent job losses.

Many of the employees temporarily laid off are receiving unemployment insurance far greater than what they earned while working. The $600 weekly extra benefit is $165 more a week for child care workers, for instance. These employees may prefer to continue receiving unemployment benefits, should their previous employers continue operating.

Similar to food, travel and events businesses, Congress might need to consider extending assistance to these businesses after the crisis ends, but also during the time they are forced to open on a limited basis. Congress will also have to address unemployment issues and job training.

4. Medical Providers

Jobs lost to date: more than 1.5 million

Percent of industry workforce lost: More than 9%

It is astonishing that, in the middle of a pandemic, we have experienced heavy job losses in the medical industry. But dentist offices, to pick one sector, have lost more than half their jobs. Medical workers should be able to go back to work faster than other industries once state and local governments lift stay-at-home orders. However, many practices will have to change how they operate to adhere to social-distancing guidelines. If this causes them to reduce the number of patients they see, they could bring back fewer employees.

5. Education

Jobs lost to date: 1.2 million

Percent of industry workforce lost: More than 8%

Like businesses schools are closed. State and local governments need to reopen schools to get these workers back on the job. School reopenings in the late summer and early fall will be complicated by the virus’ status, and the potential for another wave in the winter.

INTERACTIVE MAP: VIEW UNEMPLOYMENT GROWTH BY STATE

About the author

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.