Three tips for achieving profitability:

- Offering an ownership stake to employees can drive performance and help a startup get established.

- Keeping the business model lean early on allows startups to build a cash cushion they can fall back on.

- Looking for opportunities to optimize your supply chain early minimizes problems with sourcing and logistics down the road.

Careful planning before launching products into the market, along with zealous containment of expenses early on, helped a trio of startups attain the often-elusive goal of profitability.

Brandon Kruse, founder and CEO of livestream platform CommentSold; Ryan Close, founder and CEO of cocktail maker Bartesian; and Jack Nekhala, CEO of fitted-sheet holder Bed Scrunchie, each outlined what they said were the keys to achieving profitability at their respective companies.

Interested in a small business membership?

Find out how the U.S. Chamber of Commerce can help your company grow and thrive in today's rapidly-evolving business environment. Connect with our team to learn how a small business membership can benefit your bottom line and help you achieve your goals.

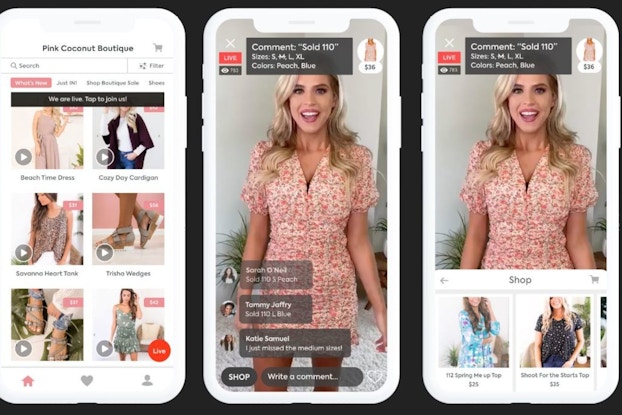

CommentSold started out as a live video platform that Kruse created to help his then-girlfriend sell clothes online, and has since seen explosive growth as a platform for retailers in a range of categories to sell products via livestream and on social media channels. Bartesian has been described as the “Keurig of cocktails” and has been rolling out its alcoholic beverage mixes both direct to consumers and to commercial accounts such as hotels and airports. Nekhala invented Bed Scrunchie, meanwhile, to solve a problem that has plagued consumers for year — ill-fitting fitted sheets.

All three companies have achieved profitability, and their trajectories have continued to rise.

‘We were profitable right out of the gate’

Ryan Close, founder and CEO of Bartesian

We were profitable right out of the gate. We took our time to build out the model and operated the business as if it was our own money, and it was. I had cashed out my 401K, and sold the car, and put it into the business. When it’s your money and not someone else’s, you spend it accordingly.

Then, when I raised money from an angel investor, I didn’t change that mindset. I treated that money as if it was my own. I looked at it as if they were buying a piece of my business, and as though they were putting their faith in me—not just [in] my company, but in me as a person—and I don’t take that lightly.

We were cautious about how we spent our money. We didn’t go out and buy swag, and shirts with [our] brand on them before we sold the product. We didn’t have ping pong tables and go out for fancy dinners. We didn’t do that, and we still don’t.

Another important thing is remaining lean. Probably almost to a fault, we waited almost until the dam burst before we added additional people to the team. People were doing two, three or four roles within the business, putting in their blood, sweat and tears, and working incredibly hard.

Bringing team members on, especially early on, is going to define the culture. The harder you push yourself, the more passionate you are going to be about it. That’s how we built the company, and we brought in some real “A” players that had that same mentality.

It helps that they had equity early on. They are not employees — they are owners; they are team members. By not adding more people early on, it helped us [to remain] lean. Our burn rate was very low, and still remains very low.

We are still [a team of] less than 20. Other companies our size have over 100 people, typically.

We launched in September of 2019, and have grown in triple digits every year, year over year, and we are on pace to do it again in 2022.

[Read: Big Brands’ Inventory Management Partners Share Top Tips to Slay Supply Chain Snarls]

We were profitable right out of the gate. We took our time to build out the model and operated the business as if it was our own money, and it was. I had cashed out my 401K, and sold the car, and put it into the business.Ryan Close, founder and CEO of Bartesian

Savvy sourcing and ‘black boxing’ thwarts copycat goods and paves the path to profit

Jack Nekhala, CEO of Bed Scrunchie

Bed Scrunchie is profitable, making over $1 million in profit in 2021 and on track to make over $2 million in profit for 2022, but we didn't become an instant success without overcoming some obstacles.

This year has been extremely challenging in the e-commerce industry, from the iOS update that drove up the cost of ads to soaring shipping prices. Making a profit has become more and more complex.

We knew this would happen, so we got creative when building the product and made sure to “black box” everything to keep the inner workings of the process hidden, to ensure we would have no competition and stay ahead.

That means the company sourced each component of the product individually from manufacturers and then assembled a team, essentially building a small workshop, to create and build the Bed Scrunchie. By black boxing everything, we could prevent any capable factories from fully understanding our invention or how it's manufactured. Moreover, by black boxing, we prevent potential copycats from appearing [online]. The more factories you approach and ask for sourcing or prototyping, the more your idea is at risk of being exposed. That would create significant obstacles when it's time to launch the product and bring it to market.

Sourcing is vital. We get the lowest cost on all components, making the product super price competitive. Also, having the right shipping partners can dictate whether you can do business or not.

We are also very creative in our marketing and email messages to help spread the word and keep costs low. We've managed to get partnerships with Good Morning America, The View and other prime-time TV spots.

A self-funding strategy that eschews VC money boosts the bottom line

Brandon Kruse, founder and CEO of CommentSold

I am a serial entrepreneur by trade, and this is the first time it came together like this. I was just solving a need for one person that happened to meet the demands of a lot of companies [seeking to sell products via livestream and on social media channels].

I have operated a company doing what I call the “VC grind,” which is, you raise some seed money, make some progress, raise a series A, make more progress, raise a series B, and so on.

I am so in love with what I call the product-market fit startup, which is building the right product for the right customer, and being obsessed with that very short feedback loop. I didn’t care about TAM [total addressable market], or the universe of all potential customers. I just wanted to find more people like my wife who were selling this way and help them sell more. That was the only theory.

We never raised money for CommentSold. It was really all self-funded, and with not that much money. I didn’t want to hire people before it became necessary. In the beginning, that was very stressful because people had to wear a lot of hats and had a big workload, myself included, so we could build up a war chest. Once CommentSold had a year’s worth of cash in terms of payroll, then I felt a little more comfortable getting on the gas and hiring a little bit faster.

It puts you in such a powerful position if you are profitable and you have cash in the bank. You can make decisions about what’s best for the company, your employees and your customers. It’s not just about how [to] get to the next fundraising milestone.

If you are spending VC money, you can trick yourself into thinking you are doing much better than you are.

Something we did at the beginning was establish an option plan, and we still have an option plan today. We have been very fortunate to have liquidity events [sales of ownership stakes allowing founders to monetize their holdings in the company] that were meaningful and life-changing for many people.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.