Coronavirus Small Business Resources Guide

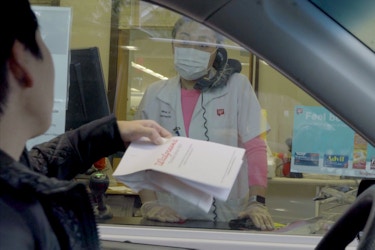

Everything you need to help your business survive and grow as you adapt to the new world of running a small business in the age of the COVID pandemic.

Latest Stimulus Package Updates

Priority Reading

Replay 3/12: Small Business Update: American Rescue Plan Act

Everything you need to know about the American Rescue Plan Act and the Restaurant Revitalization Fund.

Replay 2/25: Small Business Update: PPP for Small Businesses

The Biden Administration announced significant changes for the Paycheck Protection Program. This Small Business Updates outlines the changes and answers common questions.

10 Smart and Practical Ways to Cut Your Overhead Costs

Need to trim your overhead costs? Small business owners share their best tips for reducing expenses while maintaining employee and customer satisfaction.

5 Small Business Listings to Boost Your Online Presence

Free local business directories are an easy and free way to boost your business’s online presence. Here are five small business listings you should claim.

A Guide to Reopening Your Business

Everything you need to reopen your business and get back to work.

Find a Local Chamber

During these tough times, your state or local chamber is a tremendous resource to help your business.

Connect NowNeed an Emergency Small Business Loan?

The U.S. Chamber of Commerce has put together this Small Business Emergency Business Loan guide to walk you through it.

CO— is here to help. Help us cover the coronavirus pandemic—

Our goal is to help you navigate the challenges of the coronavirus outbreak. Join us on social media and give us your ideas, share your questions and suggest ways we can better help your business during this time.