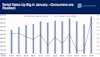

Retail sales rose a remarkable 3% in January. That is after declines in November and December, which had led many to believe consumer strength was sapped.

Why it matters: Based on last month’s data, consumers still can spend despite inflation, dwindling savings, and shrinking room on their credit cards.

By the numbers: Sales were up in almost every category:

- Motor vehicles and parts dealers (5.9%),

- Furniture stores (4.4%)

- Electronics and appliance stores (3.5%)

- Building material and garden supply stores (0.3%)

- Food and beverage stores (0.1%)

- Health and personal care stores (1.9%)

- Clothing and accessory stores (2.5%)

- Sporting goods and hobby stores (0.2%)

- General merchandise stores (3.2%)

- Food and drinking places (7.2%)

- Sales were unchanged at gas stations (0%)

Bottom line: Consumer strength has buoyed the economy since COVID. As long as the job market remains robust and incomes steady, consumers will have money to spend, even if they are falling slightly behind inflation. This could put a floor beneath spending and keep it stronger than in previous economic slowdowns.

About the author

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.