Updated

August 20, 2024

Published

October 04, 2023

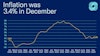

Inflation is headed in the right direction. July saw annual inflation at 2.9%, marking the first dip below 3% since 2021. This is, however, still above the Federal Reserve's target of 2%.

Why it matters: Moderating inflation can make business planning more predictable, helping companies be more productive. This will support faster economic growth and higher wages.

Big picture: Prices have risen by 17.5% cumulatively since inflation took off in March 2021, while wages have grown by 9.8%, leaving many behind.

- Faster economic growth leads to increased job opportunities, higher wages, and a better quality of life.

- That's why the Chamber is calling on candidates and elected officials to lay out plans to achieve at least 3% annual real economic growth over the next decade.

Looking ahead: Inflation’s slowdown, combined with a cooling labor market, likely means the Fed will lower interest rates in September.

Where are Mortgage Rates Headed?

March 21, 2024

Don’t expect mortgage rates to fall anytime soon. The average rate for a 30-year fixed rate mortgage is around 6.7% and has been hovering just below 7% for months.

Why it matters: Homebuyers, and the real estate market in general, want rates to fall so buying is more affordable.

Be smart: The financial markets expect the Federal Reserve to lower interest rates later this year, then hold them steady.

Looking ahead: Despite high mortgage rates, demand for housing will continue to outpace supply, keeping prices elevated.

While this will be frustrating for buyers, sellers will shoulder some of the burden as they will not be able to raise prices as much as they would have when rates were lower.

Consumer Attitudes Toward the Economy Remain Steady

March 20, 2024

Consumer sentiment about the economy, as measured by the University of Michigan, fell in early March. It has moved little over the first three months of 2024 after rising at the end of 2023.

Why it matters: Economists have long used consumer sentiment as a leading indicator for the economy, because when consumers feel better, they spend more, and vice versa.

- But over the last few years, there has been a split between headline economic data such as GDP growth, jobs, and income gains and how consumers feel about the economy. Positive data has not moved consumer sentiment.

Bottom line: Consumers are in a holding pattern in how they view the economy. Since consumer sentiment has become a less reliable indicator for tracking economic developments than it has been in the past, I will be focusing my updates on other data.

Inflation Remains Higher than Fed's Target

March 13, 2023

The Consumer Price Index, the broadest measure of consumer prices, rose 3.2% annually in February, compared with January’s 3.1% increase.

- Core prices, which strip out volatile elements like food and energy and are closely watched by the Federal Reserve, rose 3.8% annually.

Why it matters: Inflation remains above the Fed’s 2% target.

Be smart: The administration misses the mark on why inflation is happening. Instead, it takes actions that raise prices, like a regulation that will increase costs for Americans who pay their credit card bills on time.

The fact is, inflation is caused by clear and well-understood economic factors. Prices rise when we have too many dollars chasing too few goods and services. Businesses respond to these price changes.

- As the Fed slows the growth in the money supply through interest rate increases, inflation will continue falling, but that takes time.

Looking ahead: The Fed will likely hold interest rates where they are in the coming months as it allows its previous rate increases to lower inflation further.

Consumer Spending Was Up in January

March 8, 2024

Consumer spending rose 0.2% in January after growing 0.6% in December.

Details: Spending on services increased by 0.7%. Spending on goods fell by 0.8%, driven by a decline in motor vehicle and parts sales.

Why it matters: This data, along with January retail sales, indicate that consumers are spending enough to keep the economy growing at its current pace, especially if inflation continues declining.

Consumer Spending Weakened in January

March 6, 2023

Consumers pulled back on their spending last month with retail sales falling by 0.8% in January (seasonally adjusted), the largest drop since February 2023. Only furniture stores, bars and restaurants, and grocery stores saw increases.

Be smart: Analysts have been waiting for consumer spending to weaken. A strong job market and wage growth have kept this from happening.

Looking ahead: Consumer spending may rebound in the coming months, as it has after other recent drops. Pro-growth policies that keep the job market robust and incomes growing would help.

What Does January Inflation Data Mean for Interest Rates?

February 16, 2024

The Consumer Price Index, the broadest measure of consumer prices, rose more than expected in January.

- It was up 3.1% annually.

- That is lower than in December when it was 3.3% but higher than expected by financial markets.

Why it matters: Inflation remains above the Federal Reserve’s 2% target rate.Be smart: The Federal Reserve looks closely at core prices, which strip out volatile elements like food and energy. That metric rose 3.9% on an annual basis.

Big picture: January’s data likely means the Fed will continue holding interest rates steady in the coming months as it allows more time for previous rate increases to lower inflation.

Valentine's Day: Brought to You by American Business

February 13, 2024

As people celebrate Valentine’s Day with their loved ones, companies of all sizes make sure memorable moments can happen.

Why it matters: On Valentine's Day, Cupid's arrows do not just spark romance, they fire up businesses’ bottom lines. The National Retail Federation (NRF) estimates that 53% of consumers plan to celebrate, and $25.8 billion will be spent on the holiday this year, or about $185.81 per household.

By the numbers:

- Sweets are the stars. 92% of people surveyed by the National Confectioners Association said they plan to buy candy, including 58 million pounds of chocolate.

- Don’t forget the flowers.250 million roses are prepared by U.S. florists for Valentine’s Day, according to the Society of American Florists.

- Eating out. The National Restaurant Association projects that 60 million adults will go out to a restaurant, and 35 million more will order take-out or delivery.

Big picture: This spending adds up to economic opportunities for businesses of all sizes.

- Using survey data from NRF, the Chamber calculated the economic impact of Valentine’s Day in more than 300 metropolitan areas across the country. See the potential impact in your area.

Bottom line: When you embrace the spirit of Valentine’s Day remember the role American businesses play in bringing the holiday to life.

Dig deeper: This is a part of the Chamber’s “Brought to You by American Business” initiative showcasing how businesses of all sizes are behind America’s favorite cultural and sporting events and highlighting the jobs and growth they create.

Consumer Spending Rises Despite Credit Card Debt Growth Slowing

February 9, 2024

Credit card debt grew slowly in December, rising by 0.1% compared to a 1.5% increase in November.

Why it matters: Credit card debt is not necessary to fuel consumer spending. Accounting for inflation, consumer spending increased by 0.5% in December, while wages grew by 0.4%.

By the numbers: Credit card debt has risen since April 2021.

- However, credit card debt is not a systemic risk. As a percentage of income, it is still below historical norms.

- The 20-year average is 7.4%, but it is at 6.4% now.

Big picture: If our leaders support business and free enterprise Americans’ income will continue growing and they will continue to spend.

Dig deeper:

Stay up to speed on the latest developments in the U.S. economy

Job Market Gets Hotter in January

February 6, 2024

The jobs market sizzled in January with employers creating 353,000 jobs.

- For context, in 2023 an average of 244,000 jobs were created each month.

Why it matters: U.S. businesses have kept the economy strong in a challenging environment.

Details:

- Wages rose by 0.6% in January and by 4.7% compared to January 2023.

- Labor force participation was steady.

Looking ahead: The strong labor market will make it harder for the Federal Reserve to lower interest rates for fear of reigniting inflation.

Productivity Surge is a Good Sign for the Economy

February 2, 2024

American businesses and workers ended 2023 on a strong note. Productivity rose 3.2% in the 4th quarter, following increases of 3.6% and 4.9%, respectively, in the 2nd and 3rd quarters.

Why it matters: Productivity growth is a sign of a strong economy.

Be smart: When worker are more productive, businesses make more goods and services at a lower cost. Companies can afford to pay workers more and hire more while increasing profitability.

Big picture: Productivity averaged a 1.5% increase per quarter over the past decade, notes RSM Chief Economist Joe Brusuelas.

Faster productivity growth is a sign that the economy is prospering and the benefits are being shared widely.

Jobs Gap Grows as Openings Increase

January 31, 2024

Job openings grew by 100,000 to 9 million at the end of December.

Why it matters: There are almost 2.8 million more job openings than unemployed workers.

Big picture: Businesses continue adding workers, and workers remain confident they can quit their jobs and find better ones. This puts upward pressure on wages, which squeeze the margins of businesses of all sizes.

Dig deeper:

- Understanding America’s Labor Shortage

- The America Works Initiative helps employers develop and discover the talent to fill open jobs.

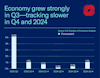

Businesses, Consumers Power Strong Q4 Economic Growth

January 26, 2024

Business investment and consumer spending drove the economy to grow by 3.3% in the fourth quarter of 2023.

Why it matters: The chances of a recession caused by higher interest rates needed to fight inflation have declined.

By the numbers:

- Consumer spending rose 2.8% with strong increases for both goods and services.

- Business investment and residential housing both grew stronger than anticipated, increasing by 1.7% and 1.1% respectively.

Looking ahead: Growth this year may not be as strong as in 2023, but the economy should still grow at or above 1% in all four quarters.

Dig deeper: What to Expect from the Economy in 2024

Business Drives Stock Market to Record Highs

January 24, 2024

The S&P 500 recently hit an all-time high, and the stock market in general has been performing well.

Why it matters: Companies investing in their businesses – which will lead to stronger growth – are making financial markets look past any possible economic hiccups in 2024.

Be smart: The markets see businesses adding workers, raising wages, and spending to better serve their customers.

Looking ahead: One risk that could deflate the stock market’s optimism is a government shutdown. Congress still needs to pass budgets for fiscal years 2024 and 2025. Washington must work on a government funding plan.

Consumer Spending Continued in December

January 19, 2024

Consumers kept spending at a strong pace. Retail sales rose 0.6% in December, double the 0.3% increase in November.

Why it matters: Analysts have been waiting for consumer spending to weaken, mostly because of depleted savings and rising credit card balances. That hasn’t happened because of the strength of the jobs market and strong wage growth.

Be smart: Spending was strong across the board in December, with auto sales and online spending leading the way.

Big picture: As long as the job market remains robust, and incomes steady, consumers will have money to keep spending.

Stubborn Inflation Stays Above Federal Reserve’s Target

January 17 2024

Taming inflation continues to be a challenge. The Consumer Price Index, the broadest measure of consumer prices, rose 3.4% annually in December. This is up from 3.1% in November. On a monthly basis, inflation was up 0.3%.

Why it matters: Inflation is still above the Federal Reserve’s 2% target but down from its peak of 8.8% in June 2022.

Be smart: The Fed looks closely at core prices, which strip out volatile items like food and energy. Core prices rose 3.9% on an annual basis and 0.3% from November to December.

Looking ahead: Even with the bump in inflation the Fed will likely hold interest rates where they are to allow more time for its previous rate increases to lower inflation.

Labor Force Shrinks in December

January 10, 2023

December’s job data was a mixed bag.

- Employers added 216,000 jobs, which was above expectations. However, previous months’ jobs gains were revised down 71,000.

- Wages rose strongly: 0.4% from November and 4.1% annually compared to December 2022.

But the labor force contracted 676,000 workers last month. There are only 0.71 workers available for every open job.

Why it matters: Usually when the economy adds jobs at a strong pace, workers come back to the labor force. The drop in the labor force could be an aberration, or it could signal that the jobs market is weakening.

What to Expect from the Economy in 2024

December 21, 2023

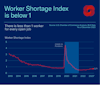

The economy faces many challenges in 2024, with the worker shortage being the key one.

Why it matters: The economy could slow in the first half of 2024 because consumer spending is likely to slow. Meanwhile, job openings are going to remain far above the number of unemployed workers. The economy is poised to grow once inflation falls further and Americans absorb the effects of higher interest rates.

Be smart:

- Consumer spending: Consumers’ pandemic-era savings are largely gone, and credit card balances have risen sharply. This will weaken spending and growth. However the worker shortage will put a floor under how much the economy slows because wages have been growing and are likely to continue.

- Inflation and interest rates: While inflation is coming down, it remains above the Federal Reserve’s 2% target. This will remain a burden on consumers’ budgets and reduce the chances the Fed can lower interest rates soon.

Bottom line: Leaders in government should be aware of the challenges businesses, families, and communities will face in 2024. Pro-growth policies should be top of mind for keeping the U.S. economy strong and Americans thriving.

Read more:

Inflation Dips but Remains Above Fed Target

December 13, 2023

The Consumer Price Index (CPI), the broadest measure of consumer prices, rose 3.1% annually in November and declined from 3.2% in October.

Why it matters: Inflation is down from the peak of 8.8% in June 2022, but still well above the Federal Reserve’s 2% target rate.

Be smart: Core prices, which strips out volatile elements like food and energy, rose 4.0% on an annual basis and 0.3% from October to November. This is a metric the Fed looks at closely, and it is still high.

- Housing, medical care, and motor vehicle insurance saw the largest monthly increases.

- Prices for apparel, household furnishings and operations, communication, and recreation decreased over the month.

Bottom line: The data likely means the Fed will hold off on interest rate hikes at least until early 2024.

Job Openings Decline But Labor Market Remains Tight

December 8, 2023

The labor market remains tight. There were 8.7 million job openings at the end of October, down 617,000 from September.

Why it matters: There are 2.2 million more job openings than unemployed workers.

Details: Hiring and quits remained at the same levels as in September. Businesses continue adding workers, and workers remain confident they can quit their jobs and find other ones easily.

Big picture: A smaller workforce is our new reality. Finding enough workers will be a challenge for businesses around the country and across sectors.

- The Chamber’s America Works Initiative assists employers in filling open jobs by helping Americans get in-demand skills, supporting government reforms so more people enter the workforce, and advocating for legal immigration reform and a secure border.

Learn more:

How U.S. Manufacturers Can Get a Boost

December 7, 2023

Manufacturing orders were down in October (the latest available data and seasonally adjusted) by almost 4%, but this was mainly due to the auto workers strikes that disrupted the industry. After excluding automotive and volatile aircraft sales, orders were down by a little over 1%.

Big picture: The manufacturing sector got a boost from the pandemic as people bought goods instead of spending on services. The decline since then is a return to the mean.

Looking ahead: High interest rates may affect the demand for higher-priced items, but if the administration would pursue a bold trade agenda to open more markets for American goods that could boost manufacturers’ confidence and competitiveness.

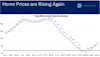

High Demand, Low Supply Keep Home Prices Up

December 1, 2023

Home prices are rising again, up 4% on an annual basis in September (the most recent available data). That marks the third straight month of gains.

Be smart: Housing prices remain high because demand outpaces supply. So even with higher interest rates, buyers are still buying because they have few options.

Why it matters: Affordable housing will remain a major issue as long as supply fails to meet demand. We must build more houses and make it easier to renovate existing stock, but too often, obstacles like permitting and zoning laws get in the way.

Holiday Shoppers Lean on Discounts and ‘Buy Now, Pay Later’

November 29, 2023

The first weekend of the holiday shopping season shows consumers are spending, but they are looking for discounts and making more use of ‘Buy Now, Pay Later’ as they contend with inflation and rising credit card balances.

Why it matters: These early trends are consistent with what we have seen from consumers for months. They continue spending with a significant portion of it from borrowing.

By the numbers: “Consumers spent a record $9.8 billion shopping online on Friday, according to Adobe Analytics,” USA Today reported.

Be smart: This early data from one segment of the retail industry (online) shows a good start to the holiday shopping season. But if the delayed-payment, bargain-hunting, and card-fueled spending trends hold, they indicate weakening consumer strength. This makes it important that leaders work to strengthen the economy so Americans’ incomes keep growing.

Falling Office Building Values Could Lead to Credit Crunch

November 21, 2023

More people working from home and higher interest rates are driving down the value of commercial office buildings. Stress in the commercial real estate market could result in a credit crunch for small- and medium-sized businesses.

Why it matters: Many of the banks that loaned money to finance large office buildings are regional ones. These are the banks that small- and medium-sized businesses rely on for access to credit.

Details: Office building occupancy is about 40% below what it was before the pandemic. As rental income fell the values of building fell too.

High interest rates are also driving down buildings’ values.

- Generally, these buildings are on five-year loans. Owners are re-financing them now at higher rates.

- Some owners find re-financing to be uneconomical and are walking away from these buildings.

Be smart: Regional banks are in the same class of banks stressed during the fallout of Silicon Valley Bank’s (SBV) failure earlier this year.

- Should financial markets scrutinize which banks are overly exposed to office space risk, this could force regional banks to pull back on lending to small- and medium-sized businesses.

Read more on the future of the office and the challenges of converting commercial office space to other uses.

Retail Sales Dip, But Consumers Keep Spending

November 17, 2023

Retail sales fell 0.1% in October, coming off a strong 0.9% increase in September.

- Auto sales amounted to much of the decline, mainly due to the auto strike. If those are taken out, sales were up 0.1%.

Why it matters: Consumers continued spending and showed resilience despite their personal savings falling and credit card balances rising.

Details: Electronics and appliance stores, food and beverage stores, health and personal care stores, non-store retailers (mostly online sellers), and bars and restaurants saw gains.

- But sales were down at motor vehicles and parts dealers, furniture stores, and miscellaneous stores.

Bottom line: If leaders avoid adding uncertainty to the economy – like from a government shutdown – and push pro-growth policies that address the worker shortage and help U.S. companies sell more to international customers, the job market will remain robust, keeping incomes steady and consumers spending.

Unpacking October Inflation Numbers

November 15, 2023

The Consumer Price Index (CPI), the broadest measure of consumer prices, rose 3.2% annually in October down from 3.7% in September. On a monthly basis, inflation was flat from September to October.

Why it matters: Inflation may be down from its peak of 8.8% in June 2022, but it is still above the Federal Reserve’s 2% target rate.

By the numbers:

- Housing was up 6.7% annually.

- Energy prices fell 4.5% annually because of a 5.3% drop in gas prices. Electricity rose 2.4%.

- New car prices rose 1.9% annually, but used car prices fell 7.1%.

- Grocery prices rose 0.3% in October and are up 2.1% annually.

Be smart: Core prices, which strips out volatile elements like food and energy and is closely watched by the Fed, rose 4.0% annually and 0.2% from September to October.

Looking ahead: This report is a step in the right direction, but we are still far from the Fed’s 2% inflation target. This improvement likely means the Fed will hold off on interest rate hikes at least until early 2024.

Consumer Strength Continued in September

November 10 , 2023

Consumers increased spending by 0.7% in September. This was 0.3% higher than inflation.

Why it matters: Consumers continue spending at a strong rate, given all the headwinds they face. If they keep spending, the economy will keep humming.

By the numbers:

- Inflation-adjusted spending on goods was up 0.3% (durables 0.6% & nondurables 0.1%).

- Inflation-adjusted spending on services was up 0.4%.

Be smart: Here are two to consider when determining if this trend continues:

- September inflation-adjusted income grew by 0.3%, slower than inflation.

- Savings dropped sharply in September and have been dropping precipitously for almost two years.

This leaves only credit cards for consumers to use to keep spending above inflation, but consumers have spent up their balances sharply in recent months.

Bottom line: Good pro-growth economic policies will strengthen the economy and support American workers and families. Making it easier to build by reforming the permitting process, addressing the worker shortage, and pushing a bold trade agenda will help.

Shrinking Labor Force Spells Trouble for Business Growth

November 8, 2023

The most concerning news from the October jobs report was that the labor force shrunk by 201,000.

Why it matters: A smaller labor force makes it difficult for businesses to find the workers they need to grow and compete, especially since job openings grew from August to September (the most recent data available).

Be smart: Scaling up skills-based employment can be a successful strategy for companies to expand talent pools beyond traditional four-year degree holders and can help workers showcase their skillsets.

Learn more: The America Works Initiative helps employers develop and discover the talent needed to fill open jobs.

Tackling the Worker Shortage with Immigration Reform

November 3, 2023

Job openings grew by 56,000 from August to September. There are 3.2 million more job openings than unemployed workers.

Why it matters: The gap between openings and available workers will persist, because we have a structural shortage of workers for the foreseeable future.

Be smart: Businesses are still adding workers, and workers are still confident they can quit their current jobs and find better ones easily.

Big picture: Employers, especially small businesses, deal with the worker shortage every day. Part of the answer is modernizing our legal immigration system to better respond to businesses’ needs. Securing our borders and updating our immigration laws to allow more workers into the U.S. would help businesses grow and prosper.

Learn more:

- The Chamber’s LIBERTY Campaign is working to pass meaningful border security and immigration legislation.

A Smaller Workforce Is the New Normal

November 1, 2023

There are too few workers relative to the size of our population, causing a chronic worker shortage that will impact businesses for the foreseeable future. I discussed the implications with Rick Wade, Senior Vice President of Strategic Alliances and Outreach at the U.S. Chamber, as part of the Equality of Opportunity Initiative.

Why it matters: An older, smaller workforce is our new reality. Every business, every industry, and every region will experience a worker shortage going forward.

Big picture: The generations that followed the Baby Boomers are notably smaller. As Baby Boomers retire, the labor force shrinks.

- And: As people get older, they consume more and produce less, which is a key issue for businesses.

What can be done: The worker shortage will likely remain a problem for years to come. Policymakers can tackle this by:

- Reforming legal immigration to bring in workers with a variety of skill levels.

- Improving second chance hiring.

And: Employers can fill the labor gap by responsibly using artificial intelligence and other technologies.

Watch my full conversation with Rick Wade here:

Learn more:

- The America Works Initiative helps companies develop and discover talent to fill open jobs and grow our economy.

What Higher Interest Rates Mean for the Federal Debt

October 27, 2023

Rising interest rates have caused the 10-year U.S. Treasury rate to bump up against 5% for the first time in 15 years. This has significant implications for the federal budget.

Why it matters: Interest costs on the national debt could reach a record share of the economy within three years, making it the second-largest federal spending item, more than defense spending or Medicare.

By the numbers: The Committee for a Responsible Federal Budget lays out the details:

- Interest costs could total more than $13 trillion over the next decade and $1.9 trillion per year by 2033.

- Most long-term forecasts suggest the economy is likely to grow by 3.5% to 4% per year over the long term. This is below the interest rate on new bonds, meaning existing debt may grow faster than the economy.

Bottom line: Interest payments on our debt, along with rising costs to retirement and healthcare programs, are pushing America’s fiscal outlook into uncharted territory. Congress must prioritize efforts to reform our entitlement programs, the major driver of our debt and deficits.

Americans Keep Pulling Out Their Credit Cards

October 25, 2023

Credit card debt jumped sharply in July and August (0.8% and 1.2% respectively), after a small decline in June.

But as a share of disposable income, credit card debt is below the 20-year average, meaning it is not at levels that would be risky to the financial system.

Why it matters: Consumers are spending at a faster pace than many analysts expected. Part of this is by using credit cards, but that may not last.

Big picture: From February 2020 to April 2021, Americans paid down the balances on their cards by $128 billion.

- Since then, credit card debt has risen $313 billion and is now $1.29 trillion – an all-time high.

This increase in credit card debt comes amid inflation struggles and high interest rates. Many Americans will have to rely more on their incomes and savings to fund their spending.

Bottom line: It is a reminder that American workers and families need a strong economy. Our leaders can do this by addressing the worker shortage, reforming the permitting process to allow us to build much-needed infrastructure, and advancing a bold trade agenda that supports American jobs.

Resilient Consumers Still Spending in September

Consumers are still spending, showing remarkable resilience. Retail sales rose 0.7% in September, coming off a strong 0.8% increase in August.

- The strong jobs market and income growth that is on pace with inflation fuels spending.

- Consumers using credit cards is also up.

Details: Big drivers of the gains in September were car sales, online purchases, and sales at miscellaneous retailers. Purchases at restaurants, bars, and gas stations were robust, too.

Big picture: A strong economy will keep consumers confident and spending. To strengthen the economy businesses need pro-growth policies that address the worker shortage and advance a bold trade agenda.

Labor Force Can’t Grow Fast Enough to Fill Job Openings

October 11, 2023

The job market continued to sizzle in September with 336,000 new jobs created – the vast majority created by the private sector. Also, job gains for July and August were revised up a combined 119,000. Workers made more as well with wages rising 0.2%, up 4.2% annually.

Why it matters: While the labor force continued growing, expanding by 90,000 in September, it’s not growing fast enough to fill millions of open jobs.

Be smart: Finding more workers is critical for businesses to grow and compete. More legal immigration is part of the solution, along with helping Americans get in-demand skills and removing barriers keeping people from entering the workforce.

By the numbers: The top five industries that added jobs in September were:

- Leisure and Hospitality: 96,000

- Government: 73,000

- Education and Health: 70,000

- Wholesale and Retail Trade: 31,000

- Professional and Business Services: 21,000

Learn more:

- The America Works Initiative is helping companies solve America’s workforce challenges.

Job Openings Rise, Tight Labor Market Continues

October 6, 2023

With the release of September jobs numbers this week, let’s look back at the last few months. After falling in June and July, job openings rose in August. The labor market remains tight.

- Job openings were 9.6 million at the end of August, up 690,000 from July.

- Businesses are still adding workers, and workers are still confident they can quit their jobs and find better ones easily.

Why it matters: As of the end of August there were 3.3 million more job openings than unemployed workers, 176,000 more than in July.

Big picture: The trend of more job openings than unemployed workers is likely to remain. Policymakers can address this by:

- Reforming legal immigration and securing our borders

- Improving childcare availability for families

- Revamping educational and job training opportunities

- Removing barriers to entering the workforce

Dig deeper: The Chamber’s America Works Initiative is tackling these issues to help employers develop and discover the talent they need and advance economic opportunity.

Inflation Strains Consumer Spending Growth

October 4, 2023

Consumer spending has driven the remarkable economic growth we have seen this year. But there are signs consumers are starting to buckle under the weight of inflation.

Why it matters: Consumers continue defying economic analysts’ predictions that their spending ability was sapped.

By the numbers:

- Inflation-adjusted spending was up 0.1%, essentially flat from July.

- Inflation-adjusted spending on goods was down 0.2% with spending on bigger-ticket durable goods down 0.3%.

- Spending on services rose 0.2% after inflation.

Be smart: While consumer spending was flat, consumer savings fell sharply in August. They have used credit cards and COVID-era savings to keep up with inflation, and their savings are likely depleted.

- August could be an aberration, but with inflation remaining higher than the Federal Reserve wants, we should watch how consumers keep ahead of it.

Bottom line: Inflation may have come down from 40-year highs, but it continues to weigh on consumers. It is critical that policymakers work to ease the burden of higher prices by avoiding overregulation, addressing the workforce shortage, and reducing tariffs.

Read more from the Chamber:

- Economic Data: Comprehensive quantitative snapshots of business sectors and topics to help business and political leaders make informed decisions.

- Workforce Data:Capturing the current state of the U.S. workforce.

- Small Business Index: The MetLife & U.S. Chamber of Commerce Small Business Index is released on a quarterly basis and is compiled from 750 unique online interviews with small business owners and operators each quarter. The Index delivers a comprehensive quantitative snapshot of the small business sector as well as explores small business owners’ perspectives on the latest economic and business trends.

- Middle Market Business Index:The survey panel consists of approximately 1,500 middle market executives and is designed to accurately reflect conditions in the middle market.

About the authors

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.