Table of Contents

The odds of a U.S. recession in 2023 are relatively high due to the Federal Reserve’s fight against inflation and attendant tightening of monetary policies. Since March 2022, the Federal Reserve has raised the federal funds rate eight times, precipitating a broad slowdown in U.S. economic activity, notably among more credit-sensitive sectors like real estate and construction.

That said, two points are worth highlighting. First, U.S. recessions are not uncommon – starting with the economic downturn in 1945, the U.S. economy has experienced 13 different recessions since World War II. Recessions are part of the economic life of a dynamic economy. Most analysts believe any U.S. recession in 2023 will be brief and fairly shallow, before rebounding in the latter part of the year. Second, notwithstanding periodic cyclical slowdowns, the U.S. economy remains one of the most dynamic and resilient economies in the world. No country produces as much output (more than $25 trillion in 2022) with so few people (less than 5% of the world population) than the United States. The United States is not only large, it is wealthy, with a per capita income of over $70,000 in 2022. According to the latest Federal Reserve Flow of Funds data, U.S. household net worth totaled a staggering $143 trillion at the end of 2022. It is these attributes that attract European firms to invest in the United States.

Drivers of foreign investment in the U.S.

- Large and wealthy consumer base

- Skilled workforce

- Rule of law and strong institutions

- Advanced technological readiness

- World-class higher education

- University-industry R&D partnerships

- Entrepreneurship culture Respect for intellectual property

- Stable and supportive business environment

Another reason: the U.S. economy is also extraordinarily diversified, which gives European firms wide breadth in terms of participating in and leveraging the U.S. market. From agriculture to aerospace, and everything in between, the United States remains a global leader and a prime market for non-U.S. firms. Energy, education, health care, life sciences, biotechnology, finance, manufacturing, steel, R&D, entertainment, transportation, social media – pick your sector, and there’s a good chance there is a mature or budding firm in the United States. America’s highly diversified economy – whether goods or services – combined with its wealthy consumers, sets it apart from the rest and is one key reason why the United States remains the global leader in attracting foreign capital.

To this point, according to the latest figures from the UN, foreign direct investment (FDI) inflows to the United States, after falling sharply in 2020 due to the pandemic-induced global recession, rebounded sharply in 2021, totaling a record $357 billion. In 2021, foreign companies invested twice as much in the United States ($367 billion) as they did in China ($181 billion) (Table 1). The United States has ranked number one in the world for FDI inflows for 16 consecutive years.

As Table 2 depicts, no country has attracted more FDI this century than the United States, taking in roughly $5 trillion cumulatively since 2000, more than the total for the next two countries (China and the UK) combined. On an aggregate basis, the U.S. attracted roughly 17% of total global foreign direct investment between 2000 and 2021. China was a distant second, with a global share of 7.8% followed by the U.K. (5.9%).

Multiple factors underpin America’s dominance in foreign investment flows. First, as we have mentioned, is America’s large and wealthy consumer base, with a population of roughly 335 million and per capita income of over $70,000. Second, the United States boasts a hypercompetitive and dynamic economy, driven by strong institutions, advanced technological readiness, world-class universities, a strong capacity and culture of entrepreneurship, and a dense web of university-industry collaborative activities in research and development (R&D). The ability to attract R&D from companies abroad is important to the innovative culture of the U.S. economy. R&D performed by affiliates of foreign companies accounts for roughly 15% of total R&D conducted by all businesses in the United States. European companies account for two thirds of foreign-funded R&D in the United States.

Additionally, European companies investing in the United States gain access to a desirable pool of skilled, flexible, and productive labor. We estimate that U.S. jobs supported directly by affiliates of foreign companies totaled 8 million in 2021, or about 6% of total private industry employment in the United States. European companies accounted for 61% of that figure, or nearly 5 million jobs.

Meanwhile, transparent rule of law, sophisticated accounting, auditing, and reporting standards, secure access to credit, ease of entrepreneurship, and respect for intellectual property rights have all contributed to the stable and supportive business environment in the United States.

Europe's Stakes in the United States

European firms maintained their dominant foreign investment position in the United States in 2022. In the first three quarters of the year, FDI inflows from Europe represented over 50% of total U.S. inflows. FDI inflows from Europe receded from the robust levels of 2021, declining to $121 billion in the January-September 2022 period. Annualizing data for the first nine months of last year, U.S. FDI inflows from Europe are estimated to come in at $170 billion of new investment in 2022, compared with $267 billion in 2021.

Total European FDI stock in the U.S. (2021)

- $2.9 trillion

- 64% of total FDI in the U.S.

nvestment inflows from individual European countries to the United States in 2022 was generally downward. Some countries posted growth in FDI flows; others saw a pullback. The traditional European leaders in terms of FDI inflows to the U.S. – the Netherlands, Germany, the United Kingdom, Ireland, and Italy – posted year-over-year decreases last year, while investment from France rebounded.

In 2023, we expect FDI inflows to the U.S. to “normalize” and trend higher in part due to the incentives in the U.S. Inflation Reduction Act, which strongly encourages U.S. in-country production via tax credits and subsidies. Domestic content requirements around renewable energy have run afoul of EU policymakers but have nevertheless captured the attention of European multinationals looking to expand their footprint in the massive U.S. market. U.S.-EU discussions are ongoing to determine how and whether products imported from Europe may be able to benefit from at least some of these provisions.

Europe continues to have an outsized investment presence in the United States, as reflected by its FDI position, which is a more stable metric of foreign investment in the United States. In terms of foreign capital stock in the United States, Europe again leads the way. The region accounted for 64% of the total $5 trillion of foreign capital sunk in the United States as of 2021. Total European investment stock in the United States of $3.2 trillion was over three times the level of comparable investment from Asia.

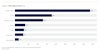

The Netherlands was the largest European investor in the United States, based on FDI on a historic cost basis, with total FDI stock in the United States totaling $630 billion in 2021. The United Kingdom ranked second in Europe ($512 billion), followed by Germany ($403 billion) and Switzerland ($282 billion). Many firms from these countries are just as embedded in the U.S. economy as in their own home markets. Only Japan has a greater investment footprint in the U.S. than the major producers of Europe.

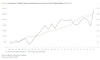

Whether Swiss pharmaceutical corporations, German auto manufacturers, or British services providers, European firms’ commercial links to America have driven corporate sales and profits higher in recent decades. European firms in the United States earned record income in 2021 in a spectacular rebound from pandemic year 2020. Things leveled off somewhat in 2022, but European firms still earned roughly $151 billion in the United States. Through the first nine months of 2022, European affiliate income earned in the United States declined to $113 billion. Taking the long view, affiliate earning levels for most European firms are significantly higher today than they were at the start of the century. As European firms have built out their U.S. operations, the payoff has been rising affiliate earnings in one of the largest markets in the world.

Table 3 highlights this connection between European investment in the United States and European affiliate earnings. The two metrics are highly correlated – the greater the earnings, the greater the likelihood of more capital investment, and the more investment, the greater the upside for potential earnings and affiliate income. The bottom line is that Europe’s investment stakes in the United States have paid handsome dividends over the years, notably since the Great Recession, given the growth differential between the United States and Europe. These higher earnings in the United States have also allowed these companies to succeed more back home in Europe – including both by expanding their operations and hiring more workers.

Europe's Stakes in America's 50 States

European firms can be found in all 50 states, and in all economic sectors – manufacturing and services alike. The employment impact of European firms in the United States is quite significant. Table 4 provides a snapshot of state employment supported directly by European affiliates across the United States. It is important to note that the chart represents only those jobs that have been directly created by European investment, and thus underestimates the true impact on U.S. jobs of America’s commercial ties to Europe. Jobs tied to exports and imports of goods and services are not included, nor are many other jobs created indirectly through suppliers or distribution networks and related activities.

Table 4: Ranking of Top 20 States by Jobs Supported Directly By European Investment

Source: Bureau of Economic Analysis. Data as of January 2023.

In general, the presence of European affiliates in many states and communities across the United States has helped to improve America’s job picture. The more European firms embed in local communities around the nation, the more they tend to generate jobs and income for U.S. workers, increase sales for local suppliers and businesses, expand revenues for local communities, and encourage capital investment and R&D expenditures for the United States.

-

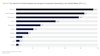

$151 billion

European affiliate earnings in the U.S.

Deep investment ties with Europe have also boosted U.S. trade. Table 5 illustrates the export potential of European affiliates operating in the United States. As a point of reference, in any given year, foreign affiliates based in the United States and exporting from there typically account for one-fourth of total U.S. merchandise exports. The bulk of these exports are intra-firm trade, or trade between the affiliate and its parent company. In 2020, the last year of available data, U.S. exports shipped by all majority-owned foreign affiliates totaled $347 billion, with European affiliates accounting for 57% of the total. German companies exported more than $47 billion in exports made in the U.S.A., while British and Dutch firms exported $42 billion and $38 billion, respectively.

Wholesale trade, transportation equipment, and chemical manufactures represented the largest categories of exports by affiliates to markets outside the United States. In the end, the more European affiliates export from the United States, the higher the number of jobs for U.S. workers and the greater the U.S. export figures.

Every U.S. state maintains cross-border ties with Europe, with various European countries serving as key export markets for many U.S. states, a dynamic that creates and generates growth in the United States. Table 6 ranks the top 20 state goods exporters to Europe in 2021, the last year of full-year state data. Texas ranked number one, followed by California, New York, and New Jersey. Overall, U.S. goods exports to Europe were up 16% in 2021; they rose again substantially by 27.3% in 2022.

U.S. merchandise exports to Europe are still more than two and half times U.S. exports to China, as shown in Table 7. Forty-five of the fifty U.S. states exported more goods to Europe than China. New York’s good exports to Europe were 8 times more than its goods exports to China. Texas exported three times more goods to Europe than to China. The largest Pacific coast state of California exported roughly twice as many goods to Europe as to China.

In addition, while these figures are significant, they actually underestimate Europe’s importance as an export destination for U.S. states because they do not include U.S. state exports of services. This is a significant additional source of jobs and incomes for U.S. workers, with most U.S. jobs tied to services. Europe is by far the most important market in the world for U.S. services, and the United States consistently records a significant services trade surplus with Europe. Suffice it to say that if services exports were added to goods exports by state, the European market becomes even more important.

-

45/50

states export more goods to Europe than to China (2021)

Appendix A highlights European-related jobs, trade, and investment for each of the 50 states.