August 29, 2019: This post has been updated to reflect new data

Since the beginning of the year, 30 percent of Fortune 500 companies have mentioned the impact of tariffs on earnings calls, according to analysis conducted by the U.S. Chamber of Commerce. The data adds to mounting empirical evidence that tariffs pose a growing concern for American businesses and present a major threat to the U.S. economy.

Using natural language processing (NLP) to map patterns in language surrounding the mentions of trade tariffs, the study found that 138 Fortune 500 companies (representing 28% of the Fortune 500) discussed the impact of tariffs on earnings calls in the first half of the year.

UPDATE: A follow-up analysis conducted this week found that a total of 158 Fortune 500 earnings calls–or 40% of recorded calls since June—have directly addressed the impact of ongoing trade tariffs and tensions on business performance.

Fortune 500 companies produce two-thirds of the U.S. GDP with $13.7 trillion in revenue and 28.7 million employees, meaning that the U.S.’s largest businesses are expressing concern at recently imposed or proposed tariffs with our country’s biggest trading partners.

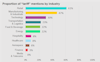

Comments surrounding tariffs on the earnings calls had the following broad themes: financial pressure, supply chain disruption, uncertainty, delayed transactions and pass-through costs to consumers. Taking a deeper dive into the data, the study found that the retail companies and manufacturing and industrial firms mentioned tariffs most frequently, at 61% and 47% respectively.

Retail and Manufacturing & Industrials were most likely to discuss the impact of tariffs on performance, with more than or nearly half of all calls discussing tariffs, respectively.

(The above chart reflect data for first 6 months of the year)

According to the analysis, companies’ concerns clustered around negative concepts like “disruption,” “uncertainty,” and “anxiety.” Many also expressed concerns in their earnings calls about how tariffs might inevitably lead to higher costs for American customers.

It’s difficult to see where the tariffs imposed on imports from China – the largest source of U.S. imports – or other countries might end and to quantify their potential impact. The U.S. has imposed a 25% tariff on $250 billion of imports from China in the past year and may extend the tariff in the weeks ahead to cover an additional $300 billion of Chinese goods.

Meanwhile, tariffs were nearly imposed on all imports from Mexico, which recently became the top U.S. trading partner. Additional tariffs have been threatened on imports of autos and auto parts, which could hit U.S. trade with the European Union and Japan particularly hard. A decision on these tariffs has been deferred until mid-November.

In the end, tariffs are a tax on imported goods, and they are paid by American families and businesses. And tariffs are known to do two things: block imports or increase their true costs. If the earnings calls are any guide, these increased costs from tariffs will almost certainly result in Americans paying more at the checkout stand for a wide range of items.

In a potentially hopeful sign, President Donald Trump and Chinese President Xi Jinping, will meet later this week at the G20 summit in Japan, giving both sides a chance to resume trade talks and avoid increasing tariffs. Without action, uncertainty and higher costs of goods will continue to plague American businesses and families.