Published

January 25, 2021

2020 was a rough year for America’s small businesses. But despite one of the sharpest downturns in American history, many small businesses demonstrated unprecedented grit, determination, and adaptability. Not surprisingly, amidst the craziness of 2020, small businesses continued to find ways to give back to their communities.

We tracked many of these trends in the MetLife and U.S. Chamber of Commerce Small Business Index (SBI). With the start of the new year and the arrival of coronavirus vaccines, many are hoping for an economic recovery to follow. It will be hard to know exactly when this recovery begins, but Curtis Dubay, senior economist at the U.S. Chamber of Commerce, says the path will be uneven initially, with some sectors doing well while others struggle in a K-Shaped Recovery.

“The economy, as it has been since March 2020, is beholden to the virus—for now. As case levels remain elevated, they will depress economic activity,” says Dubay. “This is particularly painful for businesses that cannot operate normally during the pandemic, like restaurants, bars, sporting, theatrical, and business events, conventions, theme parks, travel, tourism, film production, and others. Many of these are small businesses. Once vaccines are more widely distributed though, and case levels decline, the economy will pick up steam as those businesses ‘on the bottom of the K’ resume operating more fully. Small business optimism should rise as these things occurs. Hopefully this starts happening in a big way soon.”

Here are some of the top trends to look out for in 2021.

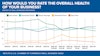

When will the SBI headline number return to normal?

The Q4 2020 SBI score was 52.9 (a slight increase of 2.6 points from Q3). However, the new score remains substantially below findings before the pandemic. The score was 71.7 in Q1 of 2020, based on data collected before the full economic impact of the coronavirus set in.

You can see the big drop off in Q2 below:

The headline number has slowly clawed its way up from its record-low (the SBI began in 2017) of 39.5 in Q2. Q4’s 52.9 is still far off from the usual 60-70 range seen before the pandemic began. This will be a key metric to watch in 2021.

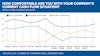

When will a solid majority see their business health as good?

Small businesses are divided on the health of their businesses according to report data. In Q4, half (50%) of small businesses said their business was in good overall health which might seem like a lot. But before the pandemic began 65% said the same (in Q1) and 69% said so in Q4 of 2019.

Also, 18% said their small business was in poor health in Q4, while half of that (9%) said their business was in poor health in Q1 2020.

Those looking for a turnaround might want to see substantially over half saying their business is in good health again. Something else to watch for next year.

When will cash flow get back to normal?

Small businesses comfort with their cash flow has been improving. A majority (59%) report comfort with cash flow, a finding that has been generally stable since the end of May. But that’s not the whole story.

14% are “not at all” comfortable with their cash flow, more than double those who said the same earlier this year (6% said so in Q1). On the other end of the spectrum, 17% are very comfortable with their cash flow, compared to 28% who said the same in Q1.

This metric has a ways to go to approach the pre-pandemic level when fully 80% of small businesses reported comfort with their cash flow.

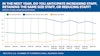

When will more small businesses pull back from plans to reduce staff?

First, the good news: most small businesses (52%) anticipate retaining the same size staff over the next year.

However, there has been a shift away from increasing staff and towards decreasing staff since the pandemic began. More small businesses planned to reduce staff in Q4 (14%, up from 9% last quarter), reaching levels not seen since the beginning of the pandemic in late April (13%). Only 5% planned to reduce staff in Q1 of 2020.

This will be one obscure—but key—number to watch in 2021.

When will small businesses see a better national economy?

Perceptions are critical in planning for a small business. If you think the economy is good, you’re more likely to invest, hire, and expand. If you think bad times will persist, you’re likely to do the opposite: trim costs, hunker down, and get your budget in tighter shape. That’s why perceptions of the economy matter—if enough business believe the same thing, perception can become reality.

Currently, small businesses don’t see a great U.S. economy. Just 29% of small businesses described the U.S. economy as good in Q4 up seven percentage points from September, but down 30 percentage points from Q1 when 60% of small businesses said the economy was good. It is also down 28 points year-on-year: in Q4 2019 57% said the national economy was good.

Overall, half (50%) of small businesses rate the overall health of the U.S. economy as poor (but down eight points from September). For context, only 12% said the national economy was poor in Q1.

The number describing small business perceptions of the American economy is perhaps the most important thing to watch in 2021—if this bounces back it should confirm we’re on the road to a solid economic recovery.

These are just some of the key metrics to watch in 2021. The next SBI (for Q1 2021) is scheduled to be released in March—so stay tuned!

The SBI is part of a multiyear collaboration by MetLife and the U.S. Chamber to elevate the voice of America’s small business owners and highlight the important role they play in the nation’s economy.

About the authors

Thaddeus Swanek

Thaddeus is a senior writer and editor with the U.S. Chamber of Commerce's strategic communications team.