Published

February 08, 2023

Despite facing challenges like inflation, worker shortages, and supply chain disruptions, small business owners feel generally good about the health of their business right now, according to the latest MetLife and U.S. Chamber Small Business Index survey.

A full 89% of small businesses said their business is in average, good, or very good health in Q4 of 2022. Of those, 64% say their business is good or very good.

However, in a stunning example of “second-hand pessimism” despite small business owners reporting their own business as healthy, they are seeing a weak economy.

When asked about their feelings on the overall economy, just 27% of small business owners feel the U.S. economy is in good health. Furthermore, a majority (54%) said the economy is somewhat or very poor.

The U.S. Chamber of Commerce has described this mismatch of sentiment as “second-hand pessimism:” Individuals and businesses report feeling bad about the economy, but they are still spending and making new investments. There is a divide between how consumers and businesses say they feel about the economy (bad) and how they’re acting (still spending).

“Small business owners did not see any improvement in the economic landscape. Although their own business may be doing okay, their confidence remains shaken,” said Tom Sullivan, Vice President of Small Business Policy at the U.S. Chamber of Commerce.

-

27%

Small business owners who believe the U.S. economy is in good health

-

30%

Small business owners who believe their local economy is in good health

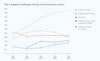

The Small Business Index data explorer tool tracks the sentiments of small business owners on the health of the economy and their business dating back to 2018. While sentiment around the health of their individual business has been growing (owners saying their business is in “very good” health is the highest it's been since Q2 2020), sentiment on the overall economy has been steady or declining since the pandemic hit.

It is also interesting to note that feelings toward the health of small business’ local economies are also low. Perceptions of the local economy declined between Q2 and Q3 2022 (from 37% to 31%), reaching the lowest point recorded since Q2 2021, and remain low today.

The negative sentiment around the local and national economy is also consistent across regions. By sector, small businesses in the services industry are more pessimistic about the U.S. economy and their local economy than those in retail and professional services.

Rhonda Sideris, president and founder of Park City Lodging in Park City, Utah, describes her feelings on the current economy.

“I am hopeful that inflation is nearing its peak. Consumer spending is still up and I’m forever the optimist. That said, the cost of doing business continues to be a challenge, with wage wars and ongoing issues with the supply chain,” Sideris said.

The challenges facing small business owners, especially soaring inflation over the last year, are weighing heavy and keeping hopes muted as owners head into an uncertain 2023.

The latest overall score of the Small Business Index of 62.1 matches last quarter’s score exactly, which marked a drop, but the Index scores over the last year have remained generally flat. In fact, the latest survey showed remarkable consistency across nearly all the questions that comprise the Index.

This consistency reflects continued feelings of uncertainty about the broader economic environment that small business owners face.

The MetLife and U.S. Chamber of Commerce Small Business Index is part of a multiyear collaboration by MetLife and the U.S. Chamber to elevate the voice of America’s small business owners and highlight the important role they play in the nation’s economy. Explore the Index here.

About the authors

Lindsay Cates

Lindsay is a senior manager on the communications and strategy team. She previously worked as a writer and editor at U.S. News and World Report.