Published

February 27, 2023

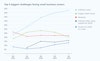

Inflation remains the single top concern among small business owners according to a recent report from the Chamber. At the same time, other concerns including revenue, supply chain issues, rising interest rates, and access to capital are viewed as second-tier challenges.

Here are the top concerns of American small businesses according to the latest MetLife and U.S. Chamber Small Business Index.

1. Inflation

Inflation remains the number one concern for small businesses by far, with more than half (53%) of them saying inflation is the biggest challenge they face. Inflation topped the list of challenges for the entirety of 2022 and is up a whopping 30-percentage-points year-over-year.

It doesn’t matter what size your small businesses or where it’s located: Inflation is the top concern for small businesses regardless of location, number of employees, or sector. Small businesses of every size have developed a number of strategies for dealing with inflation.

2. Revenue

After inflation, small businesses are concerned about an array of second-tier challenges. But prominent among them are two issues that are related to higher inflation: revenue generation and rising interest rates.

In the latest Index, 22% of small businesses reported revenue generation as a top concern. As the costs of supplies and labor rose due to inflation, small businesses struggled to generate revenue. In Q4 2022, nearly 7 in 10 small business owners said they raised prices to cope with rising inflation.

"Supply costs have increased at a rate beyond anything I could have expected," says Victoria Kidd, owner of The Hideaway Café in Winchester, Virginia. "We have incrementally raised prices several times to keep up with the rapidly changing cost of goods. Even with the increases, we're barely breaking even."

3. Rising Interest Rates

Rising interest rates are top-of-mind too, with 16% of small businesses saying rising interest rates are a top concern (up slightly from 14% in Q3). In an attempt to tamper rapid inflation, the Federal Reserve has been raising interest rates. But for small business owners who often rely on credit and loans to finance their business operations, rising interest rates are pressing concern—they essentially increase the cost of doing business.

Professional service firms are the most concerned about rising interest rates, with 22% saying it is one of their biggest challenges.

4. Supply Chain Disruptions

Concerns over supply chain issues have cooled off slightly, with just one in five (20%) small businesses citing supply chain issues as a top challenge now (down from 26% in Q3 2022).

Small businesses in the manufacturing sector are most impacted by supply chains issues (29% said it was a top issue), while services are the least impacted (only 10% report supply chains as a top challenge).

5. Access to Capital

Concern about access to financing has continued to tick up over the last year, climbing from six percent of small business owners saying it was a top concern in the beginning of 2022 (Q1 2022) to 13% citing it as a top concern by the end of the year (Q4 2022).

The size of the company has an impact on whether finding a loan or credit is a top challenge. 15% of businesses with 1-4 employees said access to capital was a challenge, while just 6% of small businesses with 20-500 employees said it was.

Likewise, there was some regional variation. 18% of Midwestern small businesses said access to capital is a top challenge. While only 8% of small businesses in the West said access to capital was one of their top problems.

Explore More Small Business Data

The Q4 2022 Small Business Index survey was conducted between October 11-27, 2022. Check out more findings from this quarter, and explore and browse years of small business data.

About the author

Thaddeus Swanek

Thaddeus is a senior writer and editor with the U.S. Chamber of Commerce's strategic communications team.