Tax Policy Memo

One Pager Tax Policy Memo

Neil Bradley

Neil Bradley

Executive Vice President, Chief Policy Officer, and Head of Strategic Advocacy, U.S. Chamber of Commerce

Published

August 26, 2024

The U.S. Chamber of Commerce (U.S. Chamber) is calling on all candidates and elected officials to embrace the Growth and Opportunity Imperative, establishing a goal of at least 3% economic growth annually and prioritizing policies that will support faster sustained economic growth. Ensuring that America has a pro-growth tax code is central to this effort.

Taxes are a fact of life. While taxes are necessary to fund the important work that only the government can do, the fact remains that they act as a disincentive on whatever is taxed. Whether it’s work, investment, or consumption, when you tax something, you get less of it. And in a global economy, the domestic rate of taxation relative to those of other nations impacts the level of investment and production a country can attract. The type and level of taxes imposed by the government directly determine how much of a drag is imposed on the economy.

Tax policy should be designed to minimize the negative impact on economic growth. Pro-growth tax policy doesn’t just grow the overall U.S. economy; it raises wages for American workers and improves standards of living. Maintaining and improving pro-growth tax policy also ensures that the U.S. is globally competitive, retaining and attracting businesses, jobs, investment, and innovation here at home.

Next year, lawmakers will have the opportunity to advance pro-growth tax policy as they work to avoid the largest tax increase in American history, which will otherwise occur automatically at the end of 2025 when many important individual, business, and estate tax provisions are scheduled to expire.

As part of our Growth and Opportunity Imperative for America, the U.S. Chamber calls on candidates and elected officials to support pro-growth tax policies that will help achieve the goal of at least 3% economic growth annually, growing the economic pie for workers and helping to make the American Dream a reality for all. Most importantly, the new Congress and administration must act to:

- Preserve our now-competitive business tax rates (i.e., 21% corporate income tax rate, 20% pass-through deduction for qualified business income);

- Ensure a competitive business tax base (e.g., one that allows a deduction for research and development (R&D) expenses, full capital expensing for certain business assets, and a pro-growth interest deductibility limitation); and

- Maintain the competitiveness of the U.S. international tax system—for both U.S. companies operating abroad and foreign companies investing in the United States—while preserving our corporate tax base.

When It Comes to Economic Growth, Not All Tax Policy Is Created Equal

Different tax policies have different effects on economic growth.

Capital Investment, R&D, and Capital Gains

Taxes on capital expenditures (e.g., certain investments in new or improved equipment, machinery, or buildings) have some of the most negative impacts on economic growth. This is because capital investments not only generate economic activity today but also support economic activity into the future. Consider an investment in a new, modern widget factory: that investment generates construction and related jobs today, but the new, more efficient factory will allow the company to produce more widgets at a lower cost for years to come.

Taxes on R&D spending have significant negative economic impacts for similar reasons. The innovations that result from a company’s investment in R&D today will result in new products and efficiencies that fuel our economy tomorrow.

When businesses are required to depreciate or amortize the costs of their capital investments or R&D expenses over several years instead of deducting them immediately in the year incurred, their current-year tax liabilities increase. Mandatory depreciation and amortization also fail to recognize opportunity cost and the time value of money (e.g., what the money could have otherwise earned), meaning businesses never truly recover the full cost of their productive investments.

Allowing businesses to immediately deduct the full cost of certain capital investments (also known as full expensing or 100% bonus depreciation) and the full amount of their R&D expenses reduces the after-tax costs of these investments, which means you get more of them.

Taxes on capital gains have a similar impact. The funds individuals use to invest in a business are the same funds the business uses to buy new equipment or conduct R&D. Individuals invest with the expectation that their investments will earn them money (capital gains), otherwise they would be better off just spending the money or leaving it in a bank account where there is no risk of loss. When the government increases the tax rate on capital gains, it decreases the return to investors and discourages more investment.

Income

When it comes to income, tax structures that are more progressive have a larger negative economic impact. This is because as rates of taxation increase, the disincentive to work or invest grows.

Imagine someone is willing to pay you $100 to perform a specific task and wants you to perform that task on five different occasions. Under a flat tax of 20%, you would take home $80 every time you perform the task.

Now consider a progressive tax increasing from 10% to 50%. The first time you perform the task you would take home $90, while the second time would net you $80. By the fifth time, however, you would take home only $50, at which point you might decide that it’s no longer worth the time or effort. Now, having performed the task only four times, there would be less economic activity, and everyone would end up worse off.

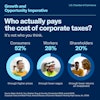

Corporate Income Taxes

Higher tax rates on business profits negatively impact the economy in at least three distinct ways. First, they reduce the return on investment to the business owners or shareholders. In the case of corporations, this is the first of two taxes that are levied. Corporate profits are taxed first at the entity level (corporate income tax) and then taxed again at the shareholder level when dividends are paid or shares of stock are sold (ordinary income or capital gains taxes). The higher the combined effective tax rate, the greater the disincentive people have to invest in these companies.

Second, as the economic literature consistently demonstrates, the incidence of the corporate income tax is not limited to shareholders—it is also borne by employees in the form of lower wages and by consumers in the form of higher prices. To attract the capital a corporation needs to operate, it must generate positive returns for its investors. Both taxes and employee wages are costs that companies must bear before returning any profit to investors. When corporate taxes increase, therefore, they consume some resources that would otherwise have flowed to employees. Similarly, to ensure a reasonable return to investors, companies facing higher taxes are often forced to raise prices on consumers.

While studies vary on the share of corporate income taxes ultimately borne by shareholders, workers (in the form of lower wages), and consumers (in the form of higher prices), one recent study put the breakdown at 52% on consumers, 28% on workers, and 20% on shareholders.

Third, American companies operate in a global economy and compete with firms headquartered around the world. When a country imposes a higher-than-normal tax rate on domestically headquartered businesses, it puts those companies at an economic disadvantage relative to their foreign-headquartered competitors. As a result, companies are incentivized to locate their headquarters and operations in lower-tax jurisdictions. This scenario played out in practice throughout the years leading up to 2017, when the United States had the highest statutory corporate tax in the industrialized world, causing many formerly U.S.-headquartered multinationals to redomicile abroad.

Tax Policy, Federal Revenue, and Deficits

Because taxes directly impact the level of economic activity that occurs in society, changes in tax policy should be analyzed dynamically as opposed to statically. Assume a country has 100 units of economic activity. If the government imposes a new average tax of $10 per unit, it shouldn’t assume that the tax will generate $1,000 in revenue (the static score). The new tax will likely discourage and reduce economic activity. If five units of economic activity disappear, then the new tax will only generate $950 in revenue (the dynamic score). Importantly, the reduced economic activity means the economy grows more slowly, ultimately making the country and its citizens poorer.

As we noted in the Growth and Opportunity Imperative memo, increasing productivity such that we increase economic growth by just half a percentage point a year, from 2% to 2.5%, would by itself decrease the federal deficit by $1.2 trillion over the next 10 years.

Pro-growth tax policy that supports more investments is key to increasing productivity.

Tax cuts and simplification can work the same way by encouraging more economic activity (that will also be taxed) and thus reducing the overall revenue loss to the government. This also means the economy grows more quickly, making the country and its citizens richer.

The major driver of current federal deficits is excessive spending. As the nearby data indicates, spending has well exceeded the historical average as a percent of the economy, while revenue has largely mirrored the historical average.

The 2017 Tax Reforms

In December 2017, Congress passed the landmark Tax Cuts and Jobs Act (TCJA), the most comprehensive tax reform legislation to be enacted since 1986. The TCJA lowered and simplified the federal income tax burden on American families and workers, and it substantially modernized the United States’ approach to taxing investment and business income.

Many of the provisions of the TCJA were designed to foster greater economic growth.

Lower Corporate Tax Rate

20% Deduction for Pass-Through Business Income

Full Expensing for Certain Capital Investments

Taxation of Multinational Corporations

Lower Marginal Tax Rates for Individuals

Impact of Pro-Growth Tax Reforms

One way to think about the economic impacts of tax policy changes is to compare post-change economic performance with what was anticipated absent any tax policy change. Of course, tax policy isn’t the only thing that can impact economic performance; other public policy changes and external factors also impact the economy. The global COVID-19 pandemic, for example, initially slowed the economy and changed the economic trajectory in subsequent years.

Comparing the performance of the economy after the TCJA’s enactment in 2017 and before the onset of the pandemic in 2020 with what economists had previously forecast can help us understand the directional impact of the law’s reforms.

To understand the impact of the TCJA we can also look at how businesses changed their behavior in the wake of the law’s enactment.

A 2024 study from economists associated with the National Bureau of Economic Research and the Treasury Department analyzed the activities of approximately 12,000 different businesses. The researchers found that the TCJA increased domestic investment in the short run by about 20% for a firm with an average-sized tax change. Investment in the United States was even larger for multinational firms, indicating that both the domestic and international changes worked together to increase capital investment in the United States. Over 15 years, the researchers estimate that the increased investment spurred by the TCJA (assuming its policies are continued) will increase the capital stock by 7.2%. This more efficient and more productive economy will, in turn, increase wages by an additional 0.9%. (See summary of the research here.)

Prior to the TCJA, America’s uncompetitive tax system was pushing companies to relocate their headquarters from the United States to lower-tax jurisdictions abroad (via so-called “inversion” transactions). From 2012 to 2016, 28 different companies took action to move their corporate headquarters outside the United States. Since the enactment of the TCJA, however, there have been no major corporate inversions.

As highlighted in the nearby chart, the TCJA’s enactment also coincided with a rapid increase in employee wages for production and non-supervisory workers (e.g., people who make things and are not managers).

Before the tax cuts, the average hourly earnings for production and non-supervisory workers were growing at a rate of 2.4% per year in 2016 and 2017. After the tax cuts, however, wage growth for these workers increased to 3.7% by October 2019.

Thanks to these gains, by April 2020, the average production and non-supervisory worker was earning about $1,400 more per year than the previous trend would have predicted.

What’s Next

Several of the TCJA’s pro-growth tax provisions have already expired or begun to phase down, with many others scheduled to expire at the end of 2025.

Businesses’ ability to immediately deduct the cost of certain capital investments (bonus depreciation) fell from 100% in 2022 to 80% in 2023 and 60% this year. Bonus depreciation is scheduled to phase out completely after 2026, further increasing the after-tax cost of purchasing new machinery and equipment.

Beginning in 2022, American businesses have been required to amortize their R&D expenses over five years (or 15 years, in some cases) instead of deducting them immediately in the year incurred—the standard since 1954. If unaddressed, mandatory R&D amortization will reduce economic growth, penalize investments by companies in R&D-intensive industries, and puts American businesses at a competitive disadvantage.

Also beginning in 2022, American businesses have been subject to a new, stricter limitation on their ability to deduct interest expenses. This new limit has increased the after-tax cost of debt-financed investments, which will lead to reduced investment, slower job creation, smaller wage increases, and lower overall economic growth.

At the end of 2025, the TCJA's lower marginal tax rates for individuals and 20% deduction for pass-through business income will expire, increasing the top marginal tax rate on pass-through businesses to 39.6%.

For multinational employers, the effective tax rates on foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI) will increase from 13.125% to 16.4%—a 25% increase. The base erosion and anti-abuse tax (BEAT) rate will also increase from 10% to 12.5%—also a 25% increase. Collectively, these tax increases will reduce the incentives for multinational companies to maintain their headquarters and intellectual property in the United States while decreasing America’s attractiveness as a destination for inbound business investment.

These changes are part of a broader set of scheduled expirations, many of which will increase taxes on American families by, for example, increasing marginal tax rates and cutting in half the value of the child tax credit and the standard deduction.

The next Congress and administration must pursue comprehensive, industry-neutral solutions for a pro-growth and globally competitive U.S. business tax system. Thoughtful tax policy can drive economic growth while improving fiscal responsibility. Policymakers must weigh the trade-offs and make informed choices to effectively shape our nation’s tax system.

The next Congress and administration must:

- Preserve our now-competitive business tax rates (i.e., 21% corporate income tax rate, 20% pass-through deduction for qualified business income).

- Ensure a competitive business tax base (e.g., one that allows a deduction for R&D expenses, full capital expensing for certain business assets, and a pro-growth interest deductibility limitation).

- Maintain the competitiveness of the U.S. international tax system—for both U.S. companies operating aboard and foreign companies investing in the United States—while preserving our corporate tax base.

Resources:

Tax Policy Memo

One Pager Tax Policy Memo

About the authors

Neil Bradley

Neil Bradley is executive vice president, chief policy officer, and head of strategic advocacy at the U.S. Chamber of Commerce. He has spent two decades working directly with congressional committee chairpersons and other high-ranking policymakers to achieve solutions.

Watson M. McLeish

Watson McLeish is senior vice president for Tax Policy at the U.S. Chamber of Commerce, where he serves as the primary adviser on all tax policy-related matters.