The U.S. Chamber of Commerce, on behalf of the American business community, is eager to work with the new administration to tackle the problems facing our economy. One of the keys to strengthening our economy is eliminating the unsustainable fiscal imbalances looming before us.

An undeniable lasting effect of President Obama’s tenure has been a significant degradation in our nation’s fiscal health. Following four years of trillion-dollar-plus deficits, the deficit eventually declined to $438 billion in 2015, slightly below the highest level of the prior administration’s. It shot up again to $587 billion in 2016. The latest assessment from the Congressional Budget Office (CBO) projects the budget to return to trillion dollar deficits starting in 2023 and to continually deteriorate thereafter.

The primary drivers for the massive increase in the deficit, according to CBO, are almost entirely accounted for by growth in outlays rather than a shortfall in revenue. Revenues are projected to remain stable over the forecast horizon, ranging from 17.8% to 18.4% of GDP, slightly above their historical average.

In contrast, outlays rise from 20.9% in 2016 to 23.4% in 2027, well above historical averages. Among the three components of government outlays, net interest and mandatory spending account for most of this increase. Under current law, discretionary spending only rises from $1.2 trillion to $1.5 trillion over the forecast horizon.

CBO projects that rising interest rates and a growing debt burden will cause net interest costs to more than triple, from $241 billion in 2016 to $768 billion in 2027. Mandatory outlays are projected to nearly double, rising from $2.4 trillion in 2016 to $4.3 trillion during the same period.

Source: The Budget and Economic Outlook: 2017 to 2027

Source: Congressional Budget Office.

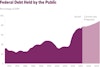

The projected rising deficits will drive up the national debt. After more than doubling under President Obama, debt held by the public is projected to grow another 75% over the next 10 years, from $14.2 trillion to $24.9 trillion.

As a share of GDP, under President George W. Bush federal debt averaged 35%. Under Obama, the average stood at 67%. By 2027, debt as a share of GDP will hit 88.9% under the policies left behind by Obama. Such a high level of debt would make the likelihood of a fiscal crisis of the sort experienced across Europe worryingly high.

President Trump continues to flesh out his policies as they relate to the fiscal picture, with a great many blanks waiting to be filled in. The good news is that part of his appeal to voters seemed to be his desire to tackle the big problems facing the country. For example, he has made clear his intention to increase substantially the pace of economic growth, which CBO forecasts will increase at a very pedestrian average of 1.9% over the next 10 years. Comprehensive tax reform and smart infrastructure investment are two areas President Trump has emphasized that would raise the growth rate.

Faster economic growth, driven by meaningful increases in productivity, would alleviate much but not all of our fiscal imbalance. Entitlement reform and other spending reforms must be a part of the mix as well. Though few in Washington want to take notice, sometime around the end of the 10-year window the Social Security and Medicare Trust Funds are projected to run dry.

About the authors

Brian Higginbotham

Brian Higginbotham is former senior economist at the U.S. Chamber of Commerce.