Neil Bradley

Neil Bradley

Executive Vice President, Chief Policy Officer, and Head of Strategic Advocacy, U.S. Chamber of Commerce

Published

July 13, 2021

There is a big debate about whether the threat of inflation – sustained and rapid general increases in prices across a wide group of goods and services – is serious enough to deserve the attention of policymakers.

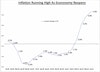

1970s and early 80s type inflation is not a forgone conclusion, but the data makes clear it is also a threat that cannot be dismissed. Earlier today, the Bureau of Economic Analysis released data showing that inflation roared to 5.4% in May; the highest inflation since July of 2008, when it was 5.5%. If sustained over time, inflation at the current level threatens to significantly curtail what should be a booming economy the rest of this year and beyond.

Since data lags and consumers adjust faster than policy can change, here are five ways Congress and the Biden administration can get in front of inflation before it is too late:

- Help get workers back to work. Today, the labor force is 3.4 million workers smaller than it was in February of 2020 before the pandemic. A severe shortage of workers is causing employers to raise wages beyond the efficiency gains, which means the additional costs must be absorbed or passed along to customers. Rising wages are usually good, but in this case they are at least partially the result of businesses competing with generous government benefits that provide some individuals with more money out-of-work than they earned working. In some cases workers are on the sidelines because they do not have access to affordable childcare. Congress should act to end the extra $300 federal unemployment benefit immediately. States, as some already have, can end those payments unilaterally and use the funds to provide an incentive for workers to return, such as a return-to-work bonus and assistance with childcare costs.

- Easing supply chain disruptions. The pandemic has wreaked havoc on some supply chains and imposed delays and added costs on some fragile parts of the system. While much attention has been paid to disruptions in specific industries like semiconductors and lumber, disruptions in the cargo industry have the potential for widespread impact as costs rise. While some of the shipping disruptions are related to COVID, in other instances other factors are to blame. For example, policymakers should be working to help America’s largest West Coast ports expand operations to alleviate backlogs.

- Reduce tariffs. Tariff relief could immediately reduce inflationary pressure. The price of steel has tripled the last six months and aluminum prices have soared. The Sec. 232 tariffs on steel and aluminum from our closest allies in Europe, Japan, and Korea adds 25% to the prices of these imported metals without doing anything to challenge of Chinese overcapacity. The administration should lift these tariffs on our allies today. While softwood lumber prices have fallen in the past six weeks, they remain twice as high as historical averages. The anti-dumping and countervailing duties on lumber from Canada are set to double later this year. The administration should reach an agreement with Canada to suspend these duties.

- Avoid massive increases in government financed consumption. Inflation is usually caused by monetary policy putting too much money into the system. But fiscal policy can contribute too when it puts too much “hot” money in people’s pockets to spend on consumption. The federal government has pumped trillions of dollars into American’s bank accounts since last year. Most of that was needed because of the pandemic, but Americans could not spend it all. There are now more than $2.5 trillion in excess savings built up in bank accounts since March 2020 waiting for consumers to spend. Those savings are a big reason for robust growth estimates for the remainder of 2020 and are contributing to inflation now as consumers spend to get ahead of higher inflation in the future. Congress should not spend trillions more to fund more consumption. Doing so would make matters worse. This is what Larry Summers has been warning about since the beginning the year. Government spending to fund consumption should not be confused with actual infrastructure spending – things like roads, bridges, tunnels, ports, airports, and other physical things our economy needs to thrive. Those are investments in our economy’s future and will boost growth over time. They will not fuel inflation now.

- Be clear the government will act to stop runaway inflation. It can’t be said enough: Inflation is an expectations game. The Biden administration, Congress, and, most importantly, the Fed need to make clear they will not let inflation run away like it last did in the early 1980s. That they will take the steps necessary to keep inflation in check and that they know what those steps are. This will give consumers, businesses, and financial markets the confidence they need that prices will remain stable.

Take these five steps and we won’t have a rerun of the inflation that plagued the economy of the late 1970s and early 1980s. When it comes to inflation, it’s always better to act sooner rather than later. The clock has already started.

About the authors

Neil Bradley

Neil Bradley is executive vice president, chief policy officer, and head of strategic advocacy at the U.S. Chamber of Commerce. He has spent two decades working directly with congressional committee chairpersons and other high-ranking policymakers to achieve solutions.

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.