Next year, lawmakers will have the opportunity to advance pro-growth tax policies as they work to avoid the largest automatic tax increase in American history when many important individual, business, and estate tax provisions are scheduled to expire.

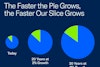

Pro-growth tax policy is essential to keeping our economy strong and competitive. As part of this effort, the U.S. Chamber of Commerce is calling on all candidates and elected officials to embrace the Growth and Opportunity Imperative, establishing a goal of at least 3% economic growth annually and prioritizing policies that will support faster sustained economic growth.

Join us on social media in calling for a pro-growth tax code.

Key Resources

U.S. Chamber Posts to Amplify

- Twitter (X): “We all benefit from pro-growth tax policy.”

- LinkedIn: “Thanks to TCJA gains, by April 2020, the average worker was earning +$1,400 more per year than the previous trend predicted.”

- Facebook, Twitter (X), and LinkedIn: “We are calling on all candidates and elected officials to embrace the Growth and Opportunity Imperative.”

Sample Social Messaging

Be sure to tag @USChamber.

Pro-growth tax policy keeps wages growing and our economy competitive. Today, I’m calling on my colleagues to champion a common-sense tax code that helps American businesses and families. https://www.uschamber.com/taxes/how-pro-growth-tax-policy-raises-wages-improves-the-economy

Higher taxes can lead to higher prices, lower wages, and smaller returns on investment, affecting everyone and making our economy less competitive. See more from the @USChamber on why we need pro-growth tax policies. https://www.uschamber.com/taxes/how-pro-growth-tax-policy-raises-wages-improves-the-economy

We’re proud to join the @USChamber in calling on candidates and elected officials to embrace the Growth and Opportunity Imperative, focusing on policies that achieve at least 3% economic growth annually.

And to achieve that growth goal, we need a smart, competitive tax code. https://www.uschamber.com/taxes/how-pro-growth-tax-policy-raises-wages-improves-the-economy

Tax policy should be designed to minimize the negative impact on economic growth. Pro-growth tax policy doesn’t just grow the overall U.S. economy; it raises wages for you and your family. I’m proud to support the priorities outlined in the @USChamber’s tax policy memo: https://www.uschamber.com/taxes/how-pro-growth-tax-policy-raises-wages-improves-the-economy

The next Congress and administration must pursue comprehensive solutions for a pro-growth and globally competitive tax system. This includes:

- Preserving our newly competitive business tax rates.

- Ensuring a competitive business tax base.

- Maintaining the competitiveness of the U.S. international tax system while preserving our corporate tax base.

https://www.uschamber.com/taxes/how-pro-growth-tax-policy-raises-wages-improves-the-economy