TO THE MEMBERS OF THE UNITED STATES CONGRESS:

As you await scoring from the non-partisan Congressional Budget Office on the latest iteration of the reconciliation bill, we request that you seek a complete accounting of the budgetary and economic impacts of the current proposal.

The Chamber believes it is impossible to have an accurate understanding of the budgetary and economic implications of this legislation without an analysis of:

1) The cost of the legislation if spending and tax provisions are not arbitrarily sunset in order to reduce the apparent cost of the bill;

2 the impact arbitrarily sunsetting new programs will have on state governments and the private sector;

3) the inflationary impact of the proposed spending and tax provisions; and

4) the impact of the policies on workforce participation.

Transparent Analysis of the True Cost Without Arbitrary Sunsets

As currently drafted, the reconciliation bill would expand or create new entitlement programs and refundable tax credits, but then sunsets many of these programs – in some cases after just one year – to disguise the true cost of the bill. Given that that the bill’s proponents clearly intend for these programs to continue past their sunset, lawmakers should be provided with a Congressional Budget Office estimate of the true cost of the bill if these programs were permanent. Experts at the Penn Wharton School at the University of Pennsylvania have estimated that if these programs were made permanent, the actual cost of the spending included in the bill would be $4.1 trillion.

However, even this analysis may undercount the true cost of the bill. The Pell Grant provision, for example, would increase the maximum award by $550 but only through 2026. Similarly, while the bill provides $22 billion for incremental rental assistance, that funding expires in 2029.

Other major sections of the bill front-load spending in the early part of the ten-year window. For example, over $20 billion is provided for workforce training and related education programs, but most of that money is only available through 2026.

A true accounting of the bill’s cost requires identifying which provisions are intended to be permanent and calculating the cost without any arbitrary sunset.

Impact of Arbitrary Sunsets on State Governments, Private Sector, and Program Implementation

Arbitrary sunsets can also have a significant impact on program implementation, state governments and the private sector. For example, the proposed legislation would make substantial investments in childcare. Under the legislation, states must agree to participate in the program, including bearing 10 percent of the costs beginning in the fourth year. In addition, private childcare providers are required, beginning after three years, to meet new federal requirements, including some affecting labor costs, that are likely to significantly increase the cost of operations. Yet, after year six, all federal funding for the program terminates. This raises questions about whether states and providers will participate in the program to begin with given the uncertainty around future funding. For those who do participate, they run a significant risk of bearing the full cost should a future Congress choose not extend the program. There are similar concerns related to the universal preschool program which requires a 40 percent state match in year six and then abruptly sunsets. The ACA expansions, which sunset after four years, could result in similar uncertainty for low-income individuals and healthcare providers.

Prior to passing the reconciliation bill, Congress should understand the impact of these sunsets, including the possibility that they will ultimately impose significant unfunded costs on state governments and the private sector.

Inflationary Impact of the Spending and Tax Provisions

Americans are already experiencing the impact of generational high inflation. In the past year, prices have risen an astounding 6.2 percent, the largest such increase in 30 years. Policymakers should be concerned about the inflationary impact of proposals that result in dramatic increases in near-term demand either directly or through increases in personal income.

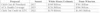

As noted earlier, much of the spending in the proposed reconciliation bill is front-loaded, meaning spending would occur in the near-term creating more demand and potentially exacerbating inflationary pressures. The analysis already released by the non-partisan Joint Committee on Taxation reveals that while the net total of the tax provisions over ten years is an increase of $945 billion in government revenue, the proposal amounts to a $120 billion tax cut in 2022 and a $54 billion tax cut in 2023. The provisions of Subtitle G – Social Safety Net of the proposed bill reduces taxes by $404 billion through 2026, but then increase taxes by $202 billion over the next five years. Altering the tax code to increase after-tax income in the near-term to be financed by increases (if continued by Congress) in later years would exacerbate inflationary pressures.

Given the substantial risk that the proposed reconciliation bill would result in a longer period of higher inflation, Congress should require an assessment of the proposed legislation’s near-term inflationary impact prior to any vote.

Impact on Workforce Participation

After enactment of the Affordable Care Act in 2010, the Congressional Budget Office released an analysis indicating that the recently enacted law would, on net, reduce the amount of labor in the economy by roughly ½ percent. These estimates were revised upwards in later years.

Today, a labor shortage crisis is one of the biggest factors holding back an economic recovery. Employers, especially small businesses, report unprecedented difficulty in filling open positions. Yet, there is no analysis of how the reconciliation bill would impact labor force participation. Some provisions, like childcare assistance, could, if structured correctly and not arbitrarily sunset, increase workforce participation while other provisions that increase transfer payments without requiring that recipients work will dampen participation.

Unlike in 2010, Congress should require an assessment of the proposed legislation’s impact on workforce participation prior to the legislation’s enactment. Such an assessment would allow Congress to prioritize policies that support work and our economic recovery.

As stated repeatedly over the last several months, the Chamber remains strongly opposed to the reconciliation bill for many reasons, including our concerns regarding its impact on the fragile economic recovery and U.S. global competitiveness. Detailed analysis on the issues identified above would at a minimum help ensure that lawmakers are making a more informed decision before moving ahead with a multi-trillion bill.

Sincerely,

Neil L. Bradley