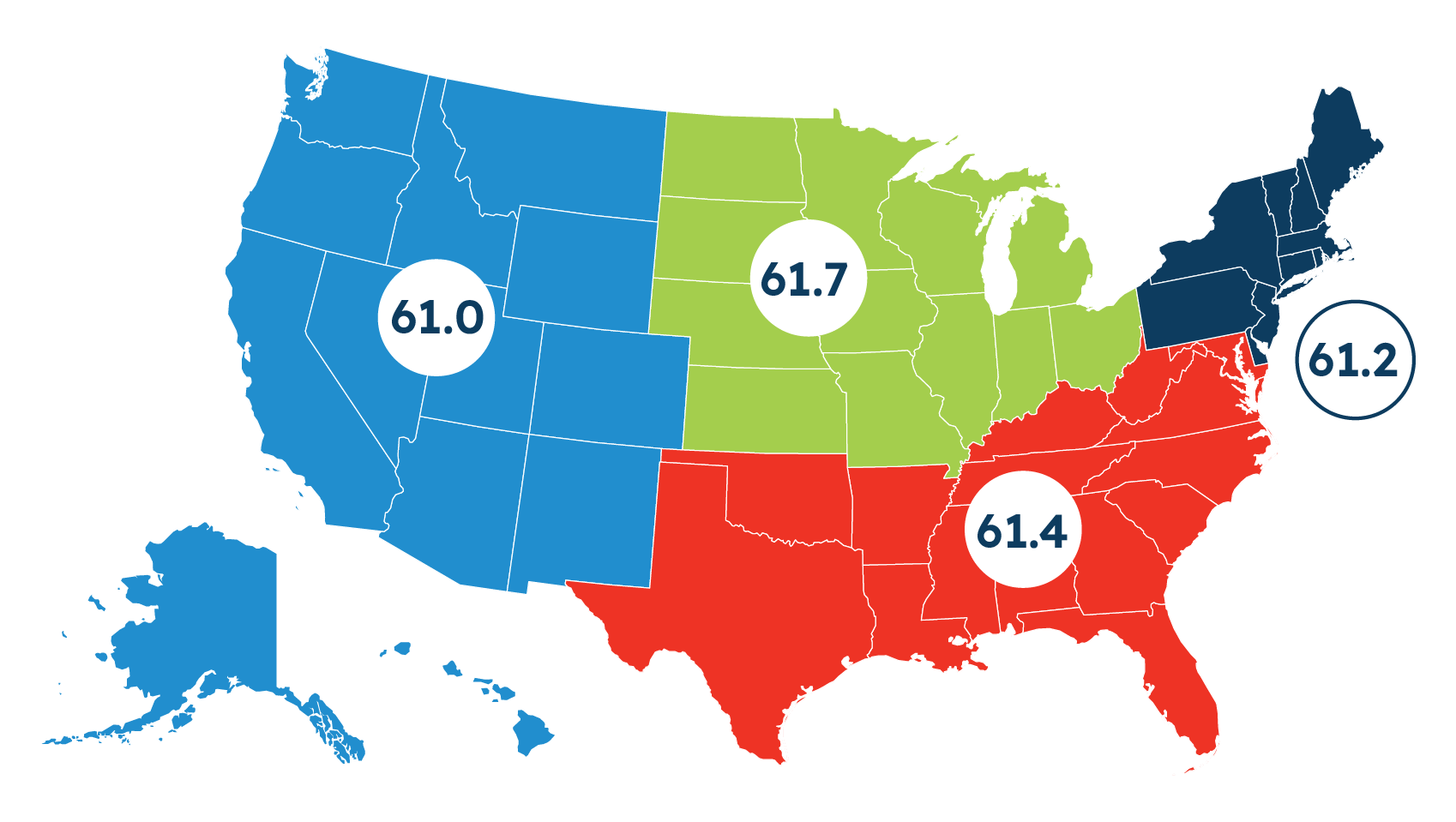

Regional Scores

National Score 61.3

South

West

Midwest

Northeast

Northeast (61.2)

Attitudes toward the economy have worsened more in the Northeast than other regions. 26% say the national economy is in good health, down from 42% last quarter. Also, there is a 15-percentage point drop from last quarter in attitudes toward the local economy. While two-thirds (65%) feel comfortable with their current cash flow, this number represents a 12-percentage point decline from last quarter. However, about two in five expect next year’s revenues to increase.

South (61.4)

Slightly more Southern small business owners say the economy is in poor health (56% now vs. 48% last quarter). Meanwhile, two-thirds (68%) feel comfortable with their cash flow. Small business owners in the South who searched for new talent this year are more likely than those in the Northeast or West to say it was hard finding candidates with the skills they need.

Midwest (61.7)

24% of Midwestern small businesses feel good about the U.S. economy, but 52% feel it is in poor health, tracking closely with the national average. Their attitudes toward their local economy remain evenly split between good and poor. However, 44% now say their local economy is average (vs. 34% last quarter). Midwestern small businesses are less likely to report plans for increasing staff next year (33%, compared to 37%-45% in other regions).

West (61)

Western small business attitudes toward the national economy have worsened from last quarter’s high point. Now, 23% say the U.S. economy is in good health, and 49% say it is in poor health. Last quarter, views were evenly split between good and poor (37% each). Fewer expect revenues to increase over the next year (64% now vs. 76% in Q3 2023), but expectations for increasing headcount remain the same.