Operations, Environment & Expectations

Small Business Operations: Small businesses stable business health, hiring, and cash flow

Business operations measures remain steady this quarter, small businesses report.

For example, two-thirds of small businesses say their business is in good health this quarter, a reading that has been relatively stable since Q2 2022.

Also, nearly seven in ten (68%) small businesses now say they are comfortable with their cash flow this quarter, compared to 73% last quarter (a slight, but not significant, shift) and similar attitudes in Q4 2023 and Q1 2024 (67% for both). This slight change in cash flow comfort is attributed to a shift in those who say they are very comfortable with their cash flow (21% vs. 26% last quarter, respectively).

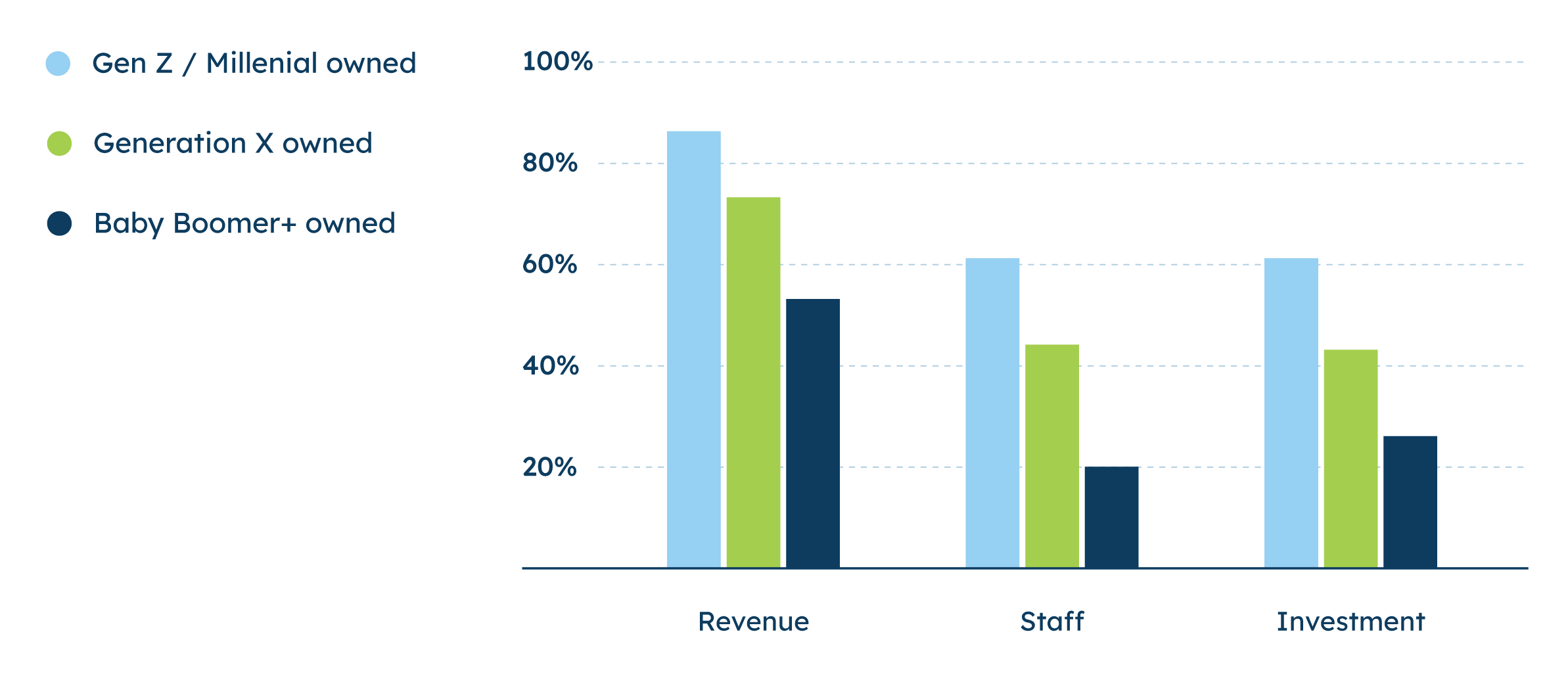

Additionally, about one-fifth (22%) of small businesses say they have increased staff over the past year, stable from last quarter and maintaining a six-percentage point increase reported from Q1 to Q2 2024 (16% to 22%, respectively). Similar to last quarter, small businesses that have been in operation for a shorter amount of time, as well as those owned by Gen Z or millennials, are more likely than their older counterparts to say they have increased staff in the past year.

For each measure of small business operations—business health, cash flow comfort, and staffing increases—there are no significant differences in sentiments by gender of ownership. There are also no significant differences in reported business health or staffing increases by sector. Yet small businesses in manufacturing are now more likely than those in retail to say they are comfortable with their cash flow (76% vs. 63%, respectively). Small businesses in services and professional services fall in the middle (66% for each sector).

By business size, small businesses with more employees are more likely to report good business health, comfort with cash flow, or increased staffing than those with fewer employees. These differences are consistent with historical patterns recorded from the start of the study in Q2 2017*.

* Beginning in Q2 2020, an online approach was used in place of the typical phone methodology. This change in mode may be responsible for some of the shifts in the data after Q1 2020.

Small Business Environment: Perception of national economy remain unchanged

Nearly two in five small businesses say the U.S. economy (35%) or local economy (38%) is in good health this quarter. While their perceptions of the national economy are consistent from the start of 2024, small businesses’ perceptions of their local economic health have slightly, but not significantly, softened from last quarter when 42% said their local economy was in good health. Regardless, small businesses’ perceptions of the U.S. economy and their local economy are relatively unchanged from Q3 2023 (33% and 38%, respectively).

A greater percentage of small businesses (48%) are negative about the national economy than positive (35%). And 38% rate the economy in their local area as good compared to those who believe their local economy is doing poorly (34%).

In a trend now observed for a full year, small businesses owned by men are more likely than those owned by women to say the national or local economy is in good health. About two in five small businesses owned by men say the national or local economy is in good health (42% and 43%, respectively). Comparably, just about three in ten small businesses owned by women say the same (27% and 31%, respectively).

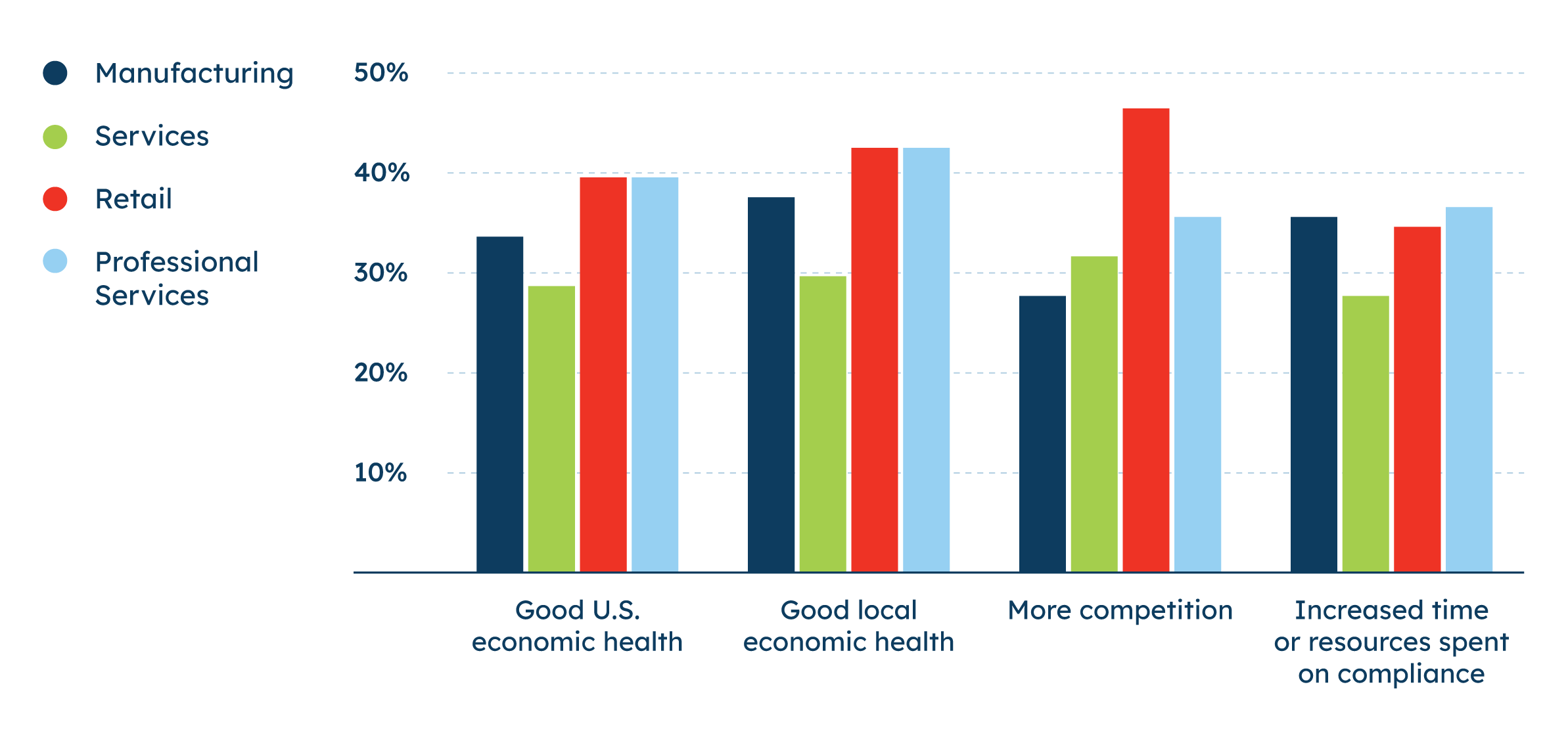

By sector, small businesses in retail or professional services are now more likely than those in services to say the U.S. economy (40% each vs. 29%, respectively) or their local economy is in good health (43% each vs. 30%, respectively). Those in manufacturing fall in the middle (34% for national; 38% for local). Last quarter, for the first time since Q3 2023, there were no significant differences in local economic perceptions by sector. Notably, this quarter’s renewed sector-by-sector differences in perceived local economic health are likely attributed to the 11-percentage-point drop in perceived local economic health among those in the service sector (30% in Q3 vs. 41% in Q2 2024).

Percentage of small businesses agreeing:

Compared to last quarter, slightly, but not significantly, more small businesses now say that the time or resources spent on compliance requirements have decreased or stayed the same in the past six months (66% vs. 62% last quarter, respectively).

Small businesses’ perceptions of increased competition from smaller or local companies, however, are stable. About two in five (36%) small businesses say that competition has increased over the past six months, relatively unchanged from last quarter (35%) and similar to this time last year (34%).

Notably, each measure of the small business environment varies by length of business operation this quarter. Small businesses that have been in operation for 10 years or less are more likely than those in operation for 11 years or more to say that competition or the time or resources spent on compliance have increased in the past six months. Further, small businesses that have been in operation for 10 years or less are more likely than those in operation for more than 20 years to say that the national or local economy is in good health. These differences in business environment measures by length of business operation are consistent with those observed last quarter; however, these differences are less consistent across the board prior to Q2 2024.

Ramsey, Minnesota

Small Business Expectations: Small businesses optimistic about the next year

Small businesses remain optimistic about the future. Nearly three-quarters of small businesses (73%) say they expect revenue to increase in the next year, unchanged from last quarter and also like Q2 and Q3 2023 (71% for each). This attitude is consistent across business size, sector, and gender of ownership.

Consistent with last quarter, 44% of small businesses say they expect to increase their staff, and 45% say they plan to increase their investment in the next year. Following an increase in optimism around these measures last quarter, small businesses are now more positive about future hiring and investments than they were at the start of the year.

While plans to increase investment in the next year are consistent by sector, small businesses in the retail (51%) and professional services (48%) sectors are more likely than those in services (35%) to say they plan to increase their staff in the next year. About two in five (41%) small businesses in manufacturing say the same.

Across each measure of business expectations—future increases in revenue, hiring, and investment—small businesses owned by men are more optimistic than those owned by women. Similarly, small businesses in operation for ten years or less, and small businesses owned by Gen Z or millennials are more optimistic about future revenue, hiring, and investment than their older counterparts.

Percentage of small businesses that expect to increase: