Index Moves Up As Optimism About the Future Grows

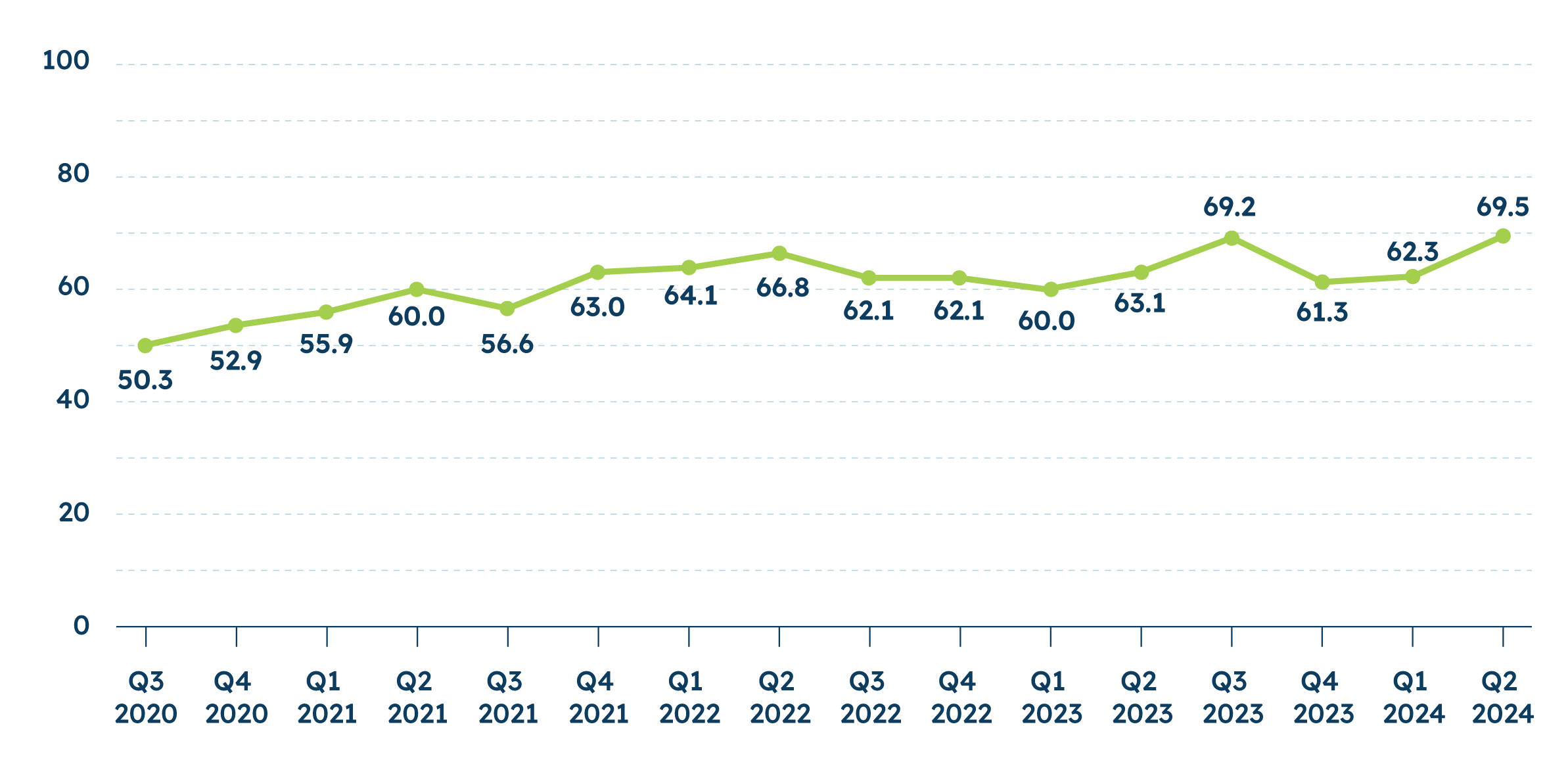

This quarter, the MetLife & U.S. Chamber of Commerce Small Business Index is 69.5, higher than last quarter’s score of 62.3, mostly due to small businesses’ growing optimism about the future business climate.

Small businesses’ perceptions of the national and local economy are generally stable from last quarter, but their concerns about inflation maintain record highs. Small businesses’ perceptions of their operations have generally improved and now closely mirror highs from Q3 2023. They’re also increasingly positive about their cash flow, hiring, and revenue expectations.

Currently, 73% of small businesses say they expect revenue to increase in the next year, the highest reading recorded since the start of this survey in Q2 2017. Nearly half (46%) say they expect to increase investment in the next year, up ten percentage points from last quarter (and just one percentage point lower than the all-time high in Q4 2022). Each of these measures (revenue expectations and planned investment) is now slightly—but not significantly—higher than those reported in mid-2023.

Small businesses are also more positive about their cash flow and have increased staff. Nearly three-quarters (73%) of small businesses say they are comfortable with their cash flow this quarter, and about one-fifth (22%) say they have increased staff in the past year. Each of these measures is now about six percentage points higher than levels reported at the end of 2023 and start of 2024. With these positive shifts, small businesses’ perceptions of business operations now closely resemble highs last reported in Q3 2023.

However, inflation remains the biggest self-reported challenge for small businesses. Inflation has topped the list of biggest challenges facing small business owners since Q1 2022 and has shown no signs of declining over the past several quarters. This quarter, 55% of small businesses say inflation is the top challenge facing the small business community. Concern with revenue (26%) stayed in the distant second position, followed by interest rates (18%) and affording employee benefits (18%).

This quarter’s survey also explores small businesses’ perceptions of artificial intelligence (AI). Small businesses are generally optimistic about the future of AI, with a majority believing hiring workers with AI skills will save them time (71%) and money (67%) in the long run. As small businesses continue to gain familiarity with AI tools, 40% of small businesses say they have tried different AI tools to suit their needs and nearly half (49%) say they plan to try AI tools in the next year. Similarly, more small businesses say they plan to establish or update a company AI policy in the next year than say they are already doing so (24% vs. 15%, respectively).

Small businesses also see AI as a vital resource that will change the future of the workforce. About half of small businesses agree they worry about the time (52%) or money (49%) it would take to bring employees up to speed on AI. Age also plays a factor in the perceptions of AI—small businesses owned by younger Americans tend to be more familiar with AI and more likely to report already using AI tools.

This all suggests that small businesses are still in the early adoption phase of exploring and implementing AI tools and policies in the workplace.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q2 is 69.5. The Q1 2024 Index score was 62.3